Learn frist: Beginners Guide to Trading

Entering the world of trading can be both exciting and challenging. With numerous strategies, terms, and platforms available, beginners often find themselves overwhelmed. This guide is designed to simplify trading concepts, offering essential tips and strategies to help you start your journey confidently.

Our topic on learning trading will cover the following points:

- What is the concept of trading?

- The skills required before learning trading.

- An overview of trading in financial markets.

- What is the difference between trading and investing?

- Learning trading is easier with electronic trading.

- Tips before entering the world of trading.

- The most frequently asked questions about trading.

What is the Concept of Trading?

Most of us engage in trading continuously in our daily lives without even realizing it. For instance, whenever we buy something from a store, it’s a form of trading—exchanging money for goods or services. Therefore, the concept of trading can be simplified as an exchange of one thing for another. Typically, when the term "trading" is used, we understand that an item or something has been exchanged for money, or in other words, buying something from one person and selling it to another.

Trading mainly relies on supply and demand. The value of an item that someone or a group of people wants to buy changes depending on fluctuations in supply and demand. Increased demand for a good or financial asset means that many people are willing to pay for it, which leads to a rise in its price.

On the other hand, an increase in the supply of a good means that there are fewer buyers or that the supply is greater than the demand. This might result in a price decrease to attract buyers.

Let’s consider the following example to understand the concept more clearly:

Imagine you are in a car market, where cars are the commodity, and you want to buy a specific model that is only available in one store that has only one car of that model. If you are the only buyer, you will likely get it at a reasonable price. However, if there are several buyers interested in the same model, competition will arise, and the seller may raise the price because many people are willing to pay for it. This explains the first principle of trading: "Increased demand leads to higher prices."

Conversely, suppose the store has 10 cars of that model and only two buyers. In this case, the store may lower the price to attract more buyers, confirming the second principle of trading: "Increased supply leads to lower prices."

In summary, trading involves exchanging something for another item of equal value, with the value determined by the strength of supply and demand. The process of trading has evolved over time, with the means of exchange changing from bartering goods to exchanging them for gold or other metals, and finally, to exchanging goods for various forms of money (cash, credit, electronic, or Crypto).

The Skills Required Before Learning Trading

After understanding the concept of trading, it’s important to know that trading is not limited to daily transactions. Trading is not just about commercial exchanges; with the presence of various financial markets, trading becomes a profession with multiple concepts, such as speculation and investment. To become a successful trader, one must possess several essential qualities that distinguish a successful trader from others.

It’s important to understand that success in trading does not happen by chance but rather through continuous effort in learning, trial and error, and ongoing development, often over long periods.

Here are the key qualities of a successful trader:

1. The Ability to Learn Continuously and Experiment:

You should have a drive to make learning trading and its basics enjoyable. Trading, like any other profession or craft, requires comprehensive understanding and mastery of the details. Markets are dynamic, constantly changing, and influenced by numerous external factors and news. There’s always something new to learn, and making learning enjoyable will help you fully benefit from what you learn.

Most successful traders learn from their past mistakes and avoid repeating them. The only way to progress is by learning from past errors and avoiding them in the future.

Always remember that you cannot beat the market, nor can you take revenge on it or defy it. Some traders have achieved significant success, leading to overconfidence and even arrogance, which drove them to take higher risks, ultimately resulting in greater losses. When facing losses in the market, do not try to take revenge or defy market movements. Give yourself time to understand the reason for the loss so you can avoid it in the next trade, thereby achieving success.

2. Risk Management Before expect profits.

Risk is a fundamental part of trading. Accepting and understanding risk and focusing on managing it are key factors in successfully managing your trades. However, most beginner traders focus solely on profits, thinking of trading as a quick way to make money without considering risk management, which exposes them to significant losses. They often forget the saying, "The greater the risk, the greater the reward," which does not mean taking on more risk in the hope of higher profits, as this would turn trading into gambling. Instead, start by focusing on protecting what you have while giving yourself the chance to earn profits.

3. Discipline and Patience:

Patience is a trait that successful traders always possess, which helps them make sound, unhurried investment decisions.

There is no strategy or approach that works all the time and generates profits. The key to success in trading is discipline, regardless of how you invest. Discipline in preparing and executing a trading plan according to what meets your trading goals is what leads to profitability.

4. Objectivity in Dealing with the Market:

Successful traders are realistic and objective about the market, allowing them to set accurate expectations that are closer to reality. They also gather all the information needed to form a clearer picture of what they are considering trading. Traders should be organized and decisive in their decisions, helping to arrange investments and understand the success rate of each trade. They can also track the overall success and failure ratios against their total capital.

Overview of Trading in Financial Markets

Just as we trade in our daily lives in various goods markets, we can also trade in different financial markets using the same principle. But before explaining the principle of trading in financial markets, let’s first understand what financial markets are. There are several main types of financial markets, or their derivatives, which can be summarized as follows:

Capital Markets, which include the stock market and bond market: When we apply the trading principle in the stock market, for example, trading involves buying a share—a small part of a company—in exchange for a certain amount of money. If the value of those shares increases, you can make money by selling them again at a higher price.

In short, trading here involves buying something at one price and selling it again at another price in the hope that the selling price is higher, thereby making a profit.

1. Foreign Exchange Market, or the Forex market: The trading principle—exchanging one thing for another—applies in the foreign exchange market, where one currency is exchanged for another. If the price of the purchased currency rises, the trader can make a profit by selling it at a higher price, and vice versa. Here again, we apply the trading principle of buying a currency at a certain price and then selling it at a different price, hoping that the price increases.

Trading in the Forex market is somewhat different from other financial markets due to its operational mechanism, known as the pairs system, which somewhat resembles a bartering system—as we discussed in detail in topics like What is Forex? and The Pairs System in the Currency Market.

2. Commodities Market: In the commodities market, which includes major commodities like wheat, sugar, cocoa, gold, and oil, commodities are traded in the form of spot, futures, or forward contracts. The trading principle is applied by purchasing a commodity contract in the hope that its price will rise in the future, or by selling a commodity contract in the hope that its price will decrease in the future. This is known as trading through Contracts for Difference (CFDs) on commodity prices.

3. Cryptocurrency Market: The trading principle is also applied in the cryptocurrency market, similar to the foreign exchange or commodities markets, by buying a specific cryptocurrency in exchange for money. If the price of the purchased cryptocurrency rises, the trader can make a profit by selling it at a higher price, and vice versa.

Before deciding to trade in various financial markets, a trader must understand the basics of trading in general, the nature of each market, and how to navigate it to develop successful strategies that simplify trading in these markets. For example, before entering the Forex market, there are key topics that a trader should be familiar with, and the same logic applies before entering the stock market, commodities market, or cryptocurrency market, among other financial markets.

- What are Financial Markets?

- What is Forex? Basics of Currency Trading.

- Advantages of Trading in Forex or the Currency Market.

- Currency Pairs Traded in Forex.

What is the Difference Between Trading and Investing?

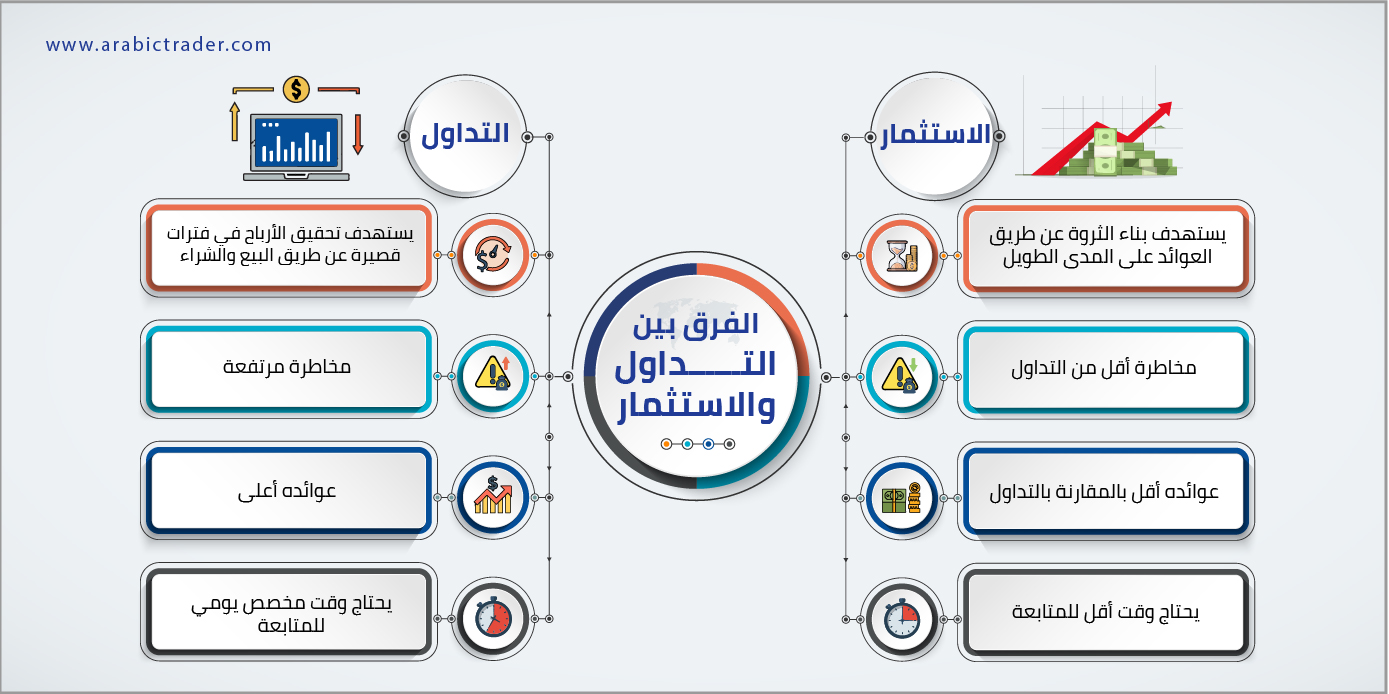

Trading or speculation and investing might share the same basic idea—risking surplus or saved money with the goal of earning a return. However, while both investors and traders aim to profit through financial markets, there is a fundamental difference between trading and investing that sets each on a different path.

The difference between the two can be summarized as follows: Investing involves using a sum of money to generate a return over a long period, whereas trading generally involves buying at a lower price and selling at a higher price to make profits over a shorter period. Investors seek to generate larger returns by purchasing and holding stocks and bonds for a long time, with the potential to earn a return without the need to sell the stock or bond, such as through dividend payouts in stocks or coupon payouts in bonds.

In contrast, traders aim to take advantage of price fluctuations in the short term, buying and selling frequently to generate profits. The time frame for trading can range from minutes to weeks, depending on the trading strategy used. Traders focus on market trends, technical indicators, and news events to make quick decisions, aiming to capitalize on market movements.

Learning Trading is Easier with Electronic Trading

The advent of electronic trading has revolutionized the financial markets, making it easier for individuals to engage in trading. The shift from traditional floor trading to electronic platforms has democratized access to markets, enabling anyone with an internet connection to participate in trading activities.

Electronic trading platforms provide real-time data, analytical tools, and automated trading options, allowing traders to execute trades quickly and efficiently. These platforms also offer educational resources, tutorials, and practice accounts, making it easier for beginners to learn the basics of trading and develop their skills without risking real money.

Moreover, the convenience of electronic trading has led to the rise of new markets, such as cryptocurrencies, which operate 24/7 and offer unique opportunities for traders. The accessibility of these platforms has lowered the barriers to entry, encouraging more people to explore trading as a potential source of income.

Tips Before Entering the World of Trading

Before diving into trading, it's essential to keep the following tips in mind to increase your chances of success:

Start with Education: Invest time in learning the basics of trading, including market dynamics, technical analysis, and risk management. Many online courses, books, and webinars can provide valuable insights into trading strategies and market behavior.

Develop a Trading Plan: A well-structured trading plan is crucial for success. Define your trading goals, risk tolerance, and strategies before entering the market. Stick to your plan and avoid making impulsive decisions based on emotions.

Practice with Demo Accounts: Most electronic trading platforms offer demo accounts where you can practice trading without risking real money. Use these accounts to test your strategies and gain confidence before trading with real capital.

Stay Informed: Keep up with market news, economic indicators, and global events that can impact the markets. Staying informed will help you make more informed decisions and anticipate market movements.

Manage Your Risk: Always use risk management techniques, such as setting stop-loss orders and limiting the amount of capital you risk on each trade. Never trade more than you can afford to lose.

Start Small: When you're ready to trade with real money, start with small amounts to minimize your risk. As you gain experience and confidence, you can gradually increase your trading capital.

Be Patient: Trading is a skill that takes time to develop. Be patient with yourself and avoid the temptation to chase quick profits. Focus on consistent, disciplined trading rather than trying to hit big wins.

Learn from Your Mistakes: Every trader makes mistakes, especially in the beginning. Treat each mistake as a learning opportunity and use it to improve your trading skills.

By understanding these concepts and following the tips outlined above, you can set yourself on the path to becoming a successful trader. Remember that trading is a journey that requires continuous learning, discipline, and perseverance.

The Forex market is often recommended for beginners due to its high liquidity, 24/7 availability, and the abundance of educational resources. However, it's essential to choose a market that aligns with your interests and goals.

The amount of capital needed to start trading depends on the market and your risk tolerance. Some markets, like Forex, allow you to start with a small amount, while others, like stocks, may require more substantial capital. Start with an amount you're comfortable losing and gradually increase it as you gain

While it's possible to make a living from trading, it's not easy, and it requires a significant amount of time, effort, and discipline. Many traders supplement their income with other sources until they have consistent success in the markets.

Trading involves significant risks, including the potential loss of your entire investment. Market volatility, unexpected news events, and psychological factors can all contribute to losses. It's essential to understand these risks and use risk management techniques to protect your capital.

Continuous education, practice, and learning from your experiences are key to improving your trading skills. Join trading communities, follow market experts, and stay updated on new strategies and technologies to enhance your trading abilities.

Technical analysis involves studying price charts and using indicators to predict future market movements. It's a crucial tool for traders, as it helps identify trends, entry and exit points, and potential price reversals.

.png)