Basic Guide To Forex Trading

In this educational article, we will spotlight a term frequently heard, especially online: the Forex Market or FOREX or the Global Currency Market.

Key points to cover for understanding the Forex market:

- What is Forex or the Foreign Exchange Market?

- How did the Forex market begin? The origin of money

- What is the trading volume in the Forex market?

- Who trades in Forex? And why its huge liquidity

- Advantages and disadvantages of Forex trading, and is Forex trading suitable for you?

- When can you trade Forex? Forex market hours and trading sessions

- What currencies are present in the Forex market? And what do currency pairs mean?

- What are the basics of Forex you need to know before starting Forex trading?

- How to start trading currencies?

- Is currency trading profitable? And what are the risks of currency trading?

- What are the most common questions about Forex?

What is Forex or the Foreign Exchange Market?

Forex, or FOREX, stands for Foreign Exchange Market and is also abbreviated as FX. Forex is one of the most famous financial markets, being a massive financial arena where currencies are traded between millions of investors, banks, and investment funds. The main goal is to profit from fluctuations in currency exchange rates through buying and selling operations. The Forex market has flourished due to technological advances, the spread of the internet, and modern communication methods. It is a decentralized market with no geographical boundaries, operating in an OTC (Over-The-Counter) system.

How did the Forex market begin? The origin of money

Forex began based on the principle of barter, where ancient people exchanged goods without money. Barter was the foundation of currency trading, later replaced by gold, silver, and other precious metals. Eventually, paper money emerged, representing a specific amount of gold. This marked the beginning of the money we know today.

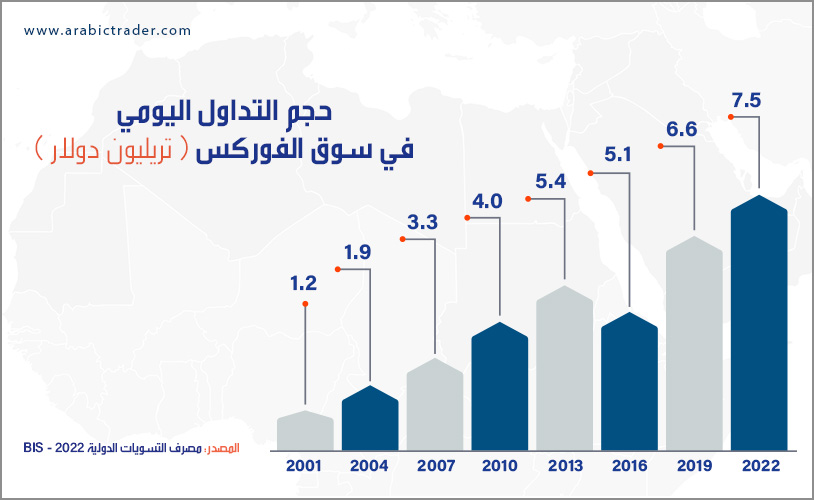

What is the trading volume in the Forex market?

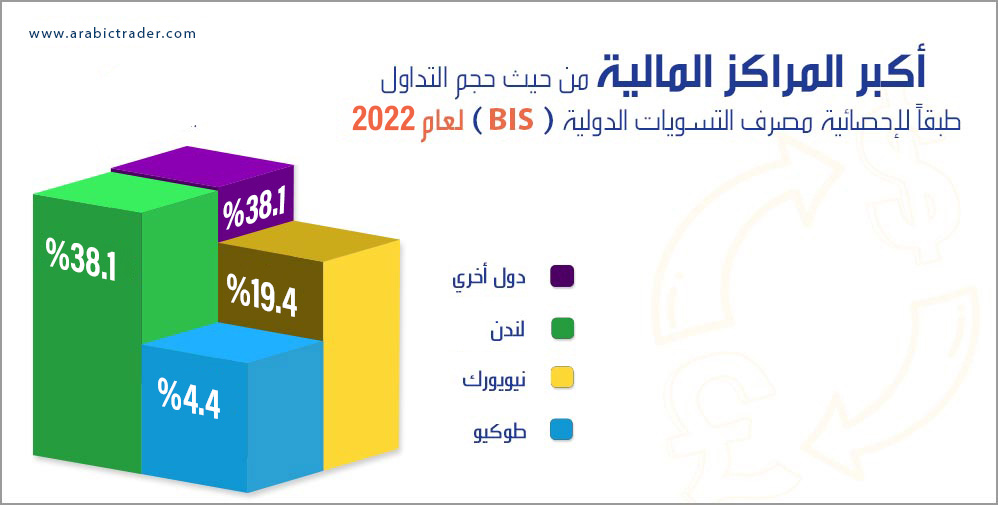

The Forex market is the largest financial market globally in terms of liquidity and trading volume, reaching $7.5 trillion daily as of April 2022, equivalent to approximately 28.2 trillion Saudi Riyals daily. Forex’s liquidity far exceeds any other financial market. For comparison, the New York Stock Exchange (NYSE), the largest stock market, has a daily trading volume of about $70 billion.

Who trades in Forex? And why its huge liquidity

The massive liquidity in the Forex market is due to various traders, including major investment banks, central banks, investment funds, asset management firms, brokerage firms, individual traders, and those trading for non-financial purposes like hedging. The development of online trading and financial leverage also attracts more investors to the Forex market daily.

Advantages and disadvantages of Forex trading, and is Forex trading suitable for you?

Key Advantages:

- Huge liquidity and high trading volume in Forex

- Forex trading is open 24 hours, 5 days a week

- Decentralized trading – OTC

- Easy to follow Forex market news

- Ability to profit from rising or falling currencies

- Trading with small amounts due to financial leverage

- Easy to open a real trading account

Disadvantages:

- Price volatility and activity

- High risk

- Limited regulatory oversight

When can you trade Forex? Forex market hours and trading sessions

The Forex market operates through various communication channels worldwide without a central geographic location. It operates 24 hours a day, 5 days a week, from Monday to Friday, and is closed on weekends. Forex trading spans four main sessions: the American, European, Asian, and Australian sessions, overlapping to provide continuous trading.

.jpg)

What currencies are present in the Forex market? And what do currency pairs mean?

Forex trading involves trading the currencies of major economies. The most traded currencies are:

- USD (US Dollar)

- EUR (Euro)

- GBP (British Pound)

- JPY (Japanese Yen)

- AUD (Australian Dollar)

- NZD (New Zealand Dollar)

- CAD (Canadian Dollar)

- CHF (Swiss Franc)

Trading in currency pairs in the Forex market

Forex trading involves trading currency pairs, where one currency is bought and another is sold simultaneously. Each currency pair has an exchange rate representing the cost of one currency relative to the other. For instance, to buy one Euro, you might need to pay 1.17189 USD.

What are the basics of Forex you need to know before starting Forex trading?

- Currency pairs traded in Forex

- Spread or the difference between buying and selling prices

- What is a PIP and how to calculate profits and losses

- Buying and selling methods, trade size, and contract types

- Leverage and margin in Forex

- Margin Call or Stop Out

How to start trading currencies?

To begin trading currencies, open an investment account with a Forex broker. Brokers offer financial leverage, allowing trading with larger amounts than deposited. To trade in Forex, you should:

- Learn Forex trading basics and terms.

- Learn to use Forex trading platforms.

- Learn to analyze Forex price movements.

- Manage Forex trading capital.

- Develop a Forex trading plan.

- Practice with a demo account before risking real money.

- Choose a reputable Forex broker and open a real account.

Is currency trading profitable? And what are the risks?

Currency trading offers flexibility compared to stock trading in risk management. High returns are possible with increased risk, as Forex trading often involves leverage. Therefore, it’s crucial to understand Forex trading thoroughly and trade only with surplus funds.

Forex trading involves buying and selling currency pairs in the Foreign Exchange Market to profit from changes in exchange rates.

Forex trading works by exchanging one currency for another in pairs. Traders aim to profit from changes in the exchange rates of these pairs.

Forex trading involves high risk due to market volatility, the potential for significant losses, and the use of leverage which can amplify both gains and losses.