What is currency pair in forex

Understanding the mechanism of trading in Forex through currency pairs can be challenging for new traders, especially those coming from a stock market background, as there are some differences. In this article, we will shed light on the concept of currency pairs in the Forex market, along with an overview of the most popular and significant currency pairs traded in the market.

Key Points Covered in This Article:

Most Popular and Strongest Currencies in the World

Before discussing the concept of currency pairs in Forex, it's essential to know the most popular global currencies, which belong to major economies. There are eight primary currencies:

- US Dollar (USD) - Currency of the United States, often referred to as "Buck."

- Euro (EUR) - Currency of the Eurozone countries, referred to as "Fiber."

- British Pound (GBP) - Currency of the United Kingdom, often called "Cable."

- Japanese Yen (JPY) - Currency of Japan, referred to simply as "Yen."

- Australian Dollar (AUD) - Currency of Australia, called "Aussie."

- New Zealand Dollar (NZD) - Currency of New Zealand, known as "Kiwi."

- Canadian Dollar (CAD) - Currency of Canada, often referred to as "Loonie."

- Swiss Franc (CHF) - Currency of Switzerland, called "Swissy."

Concept of Currency Pair Trading

In Forex, trading differs slightly from stock market trading. The trading process involves not one currency but two currencies together. When you buy one currency, you are simultaneously selling another, similar to a barter system.

For example, if you have a certain amount of US Dollars and you go to a currency exchange office to convert your dollars into Saudi Riyals, the process involves two currencies. You sell dollars to buy Saudi Riyals based on the exchange rate of the US Dollar against the Saudi Riyal. This is essentially what happens in the Forex market.

Thus, trading in Forex is known as currency pair trading, where two currencies are paired together to trade one against the other.

For clarity, let’s consider the following example:

The first currency in the currency pair is called the Base Currency, and the second is the Counter Currency. Each currency pair has an exchange rate.

In the previous example, the Base Currency is the US Dollar (USD), and the Counter Currency is the Saudi Riyal (SAR), with the exchange rate indicating how much of the Counter Currency "Saudi Riyal" is required to purchase one unit of the Base Currency "US Dollar." In this case, it is 3.7509 SAR for one USD.

Most Common Currency Pairs in Forex

Currency pairs in Forex vary in terms of trading volumes, popularity, and the ease of executing their trades. The most commonly categorized currency pairs can be divided into three classifications:

- Major Currency Pairs

- Cross Currency Pairs

- Exotic Currency Pairs

In the following sections, we will explore each classification and the currencies it includes:

Major Currency Pairs

These are the currency pairs that involve the US Dollar (USD) as one of the currencies, whether as the Base Currency or the Counter Currency. The other currency is typically from major industrialized nations, such as those in the Eurozone, Japan, Britain, Switzerland, Canada, Australia, and New Zealand. The major currency pairs include:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

- USD/CAD (US Dollar/Canadian Dollar)

- AUD/USD (Australian Dollar/US Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

Why is the US Dollar the Strongest Currency?

It has held a dominant position since the end of World War II and the signing of the Bretton Woods Agreement, which pegged the value of currencies to the US Dollar. The US Dollar is considered the primary reserve currency for central banks across the globe and serves as the pricing benchmark for most commodities, including gold, oil, and silver. Thus, it can be said that the US Dollar is the undisputed king of currencies.

It’s worth noting that trading with major currencies is one of the key advantages of Forex for traders, as approximately 90% of Forex trading volume occurs with major currencies (including the US Dollar, British Pound, Euro, Japanese Yen, Swiss Franc, Canadian Dollar, Australian Dollar, and New Zealand Dollar). Therefore, keeping track of these currencies creates excellent trading opportunities.

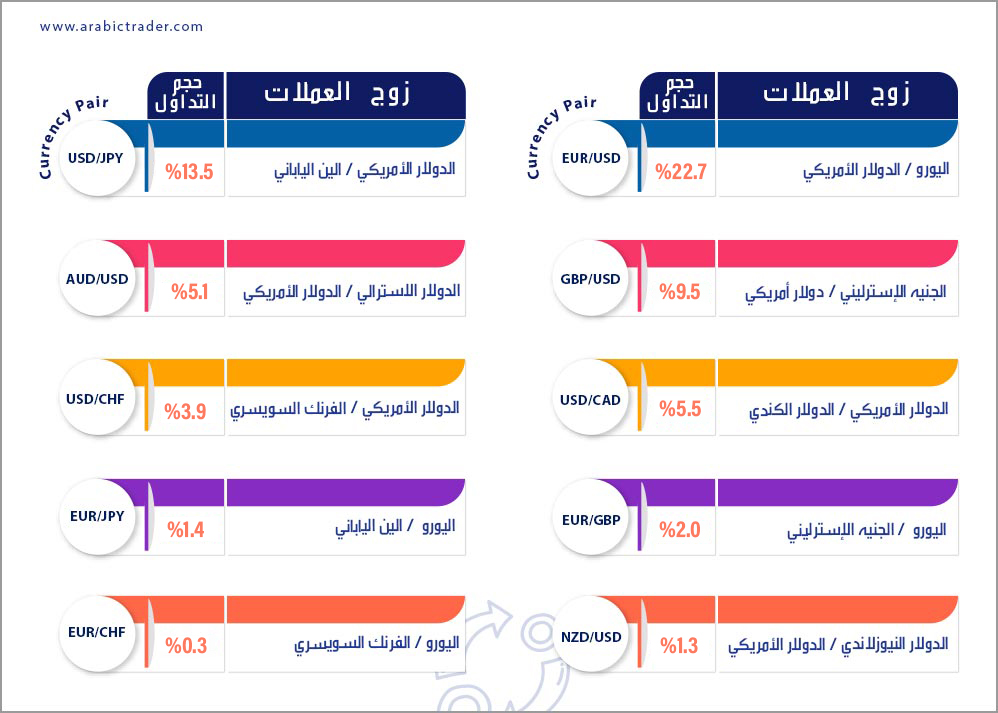

The table shows the trading volumes of the most popular currency pairs in Forex, according to the latest data from the Bank for International Settlements (BIS) for 2022.

Cross Currency Pairs

These are currency pairs that do not involve the US Dollar. Typically, the liquidity and trading volumes in cross currency pairs are lower than in major currency pairs, leading to wider spreads (to be explained in the next lesson). Cross currency pairs attract the attention of Forex traders due to their significant price movements, especially when both currencies involved are major currencies.

Some popular cross currency pairs in Forex include:

- EUR/GBP (Euro/British Pound)

- EUR/JPY (Euro/Japanese Yen)

- EUR/CHF (Euro/Swiss Franc)

- GBP/JPY (British Pound/Japanese Yen)

We can see the trading volumes of some cross currency pairs in the previous trading volume table, showing how some compete with major pairs in terms of liquidity and strength.

Why are They Called Cross Currency Pairs?

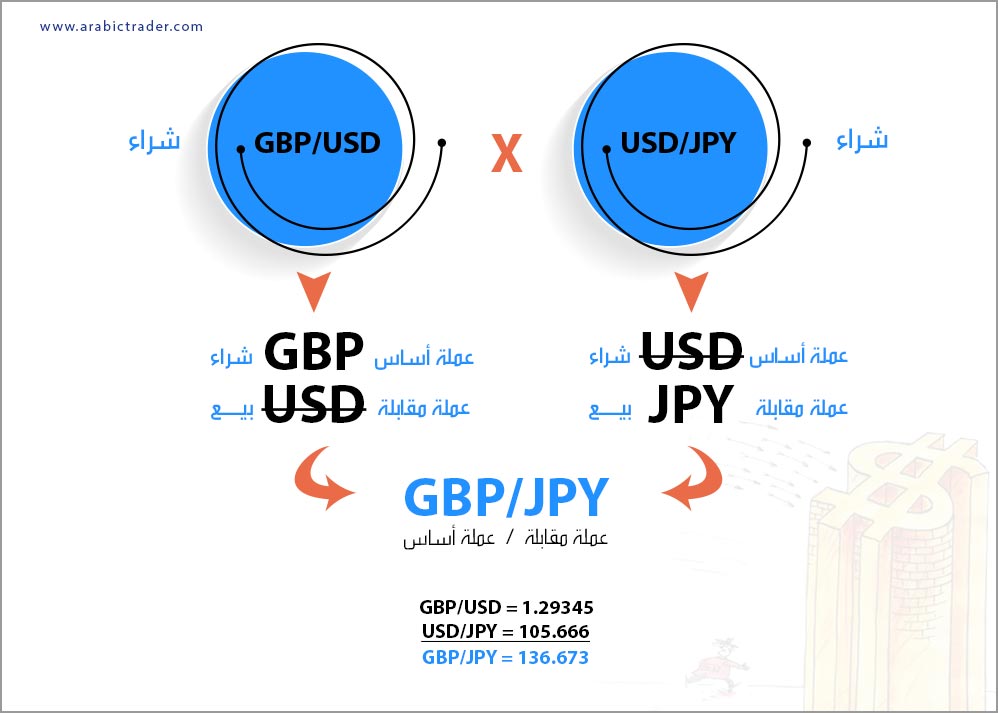

They are termed "cross currency pairs" because their exchange rates are derived from the intersection of two major currency pairs, meaning they equal the product of the two pairs' rates, as illustrated in the following example:

To obtain the exchange rate for the GBP/JPY pair, we multiply the exchange rate of the British Pound against the US Dollar (GBP/USD) by the exchange rate of the US Dollar against the Japanese Yen (USD/JPY).

Exotic Currency Pairs

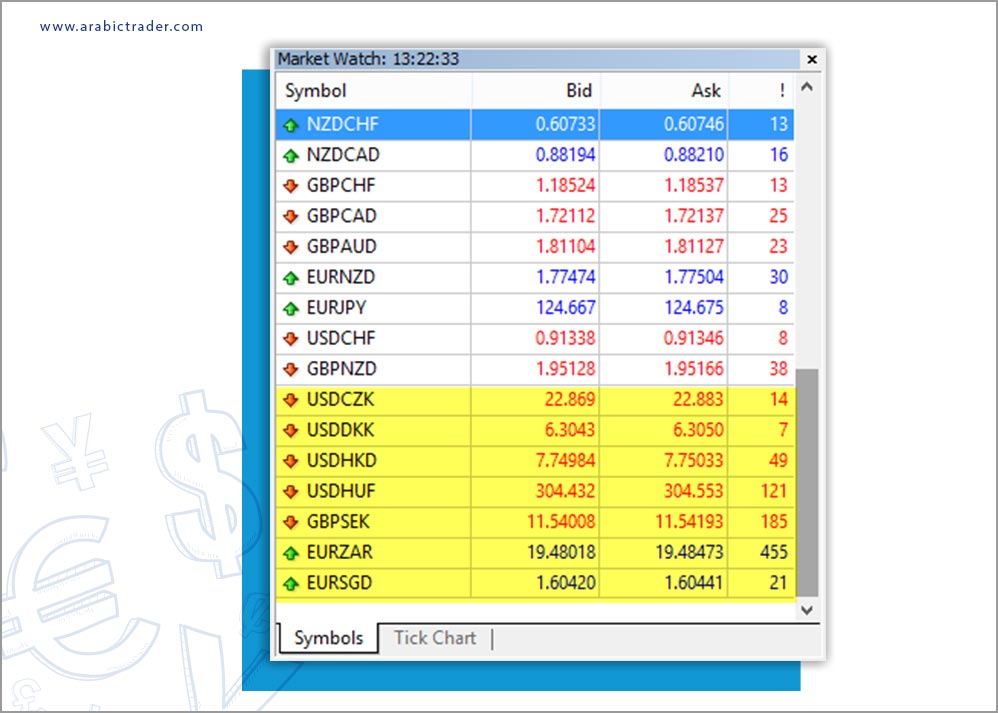

In Forex, exotic currency pairs consist of currencies from emerging markets. These pairs do not have the same level of liquidity or trading volumes as major currencies, and typically have much larger spreads. Exotic pairs usually involve the US Dollar or other major currencies, such as:

- USD/DKK (US Dollar/Danish Krone)

- USD/HKD (US Dollar/Hong Kong Dollar)

- EUR/ZAR (Euro/South African Rand)

- GBP/SEK (British Pound/Swedish Krona)

Note that the naming of currency pairs in Forex regarding the order of the first currency ("Base Currency") or the second ("Counter Currency") is standardized and never changes. For example, the Australian Dollar/US Dollar (AUD/USD) will always remain as such and cannot be referred to as (USD/AUD). The distinction between the Base Currency and the Counter Currency is crucial in the mechanism of currency trading, which we will explain in detail in the next article, focusing on trading methods.

Conclusion

Understanding currency pairs is essential for anyone looking to trade in the Forex market. By recognizing the characteristics of major, cross, and exotic pairs, traders can better navigate the complexities of currency trading and make informed decisions. With the right knowledge and strategies, Forex trading can be a rewarding venture.

Major currency pairs include USD/EUR, USD/GBP, USD/JPY, and others that involve the US Dollar as one of the currencies.

The US Dollar has been the dominant currency since the Bretton Woods Agreement, serving as the primary reserve currency globally.

Cross currency pairs do not involve the US Dollar and include pairs like EUR/GBP and GBP/JPY.

Exotic pairs consist of currencies from emerging markets and are less liquid than major pairs, such as USD/DKK and USD/HKD.