Pips in Forex: Calculating Profits and Losses

Many traders in the foreign exchange market often use terms that may be unfamiliar, such as "the EUR/USD pair moved 50 pips today," or "I traded the GBP/USD pair with 10 lots and made or lost $1,500." What do these terms mean? What does "pip" mean in forex, and what is a "lot"? How are profits and losses calculated? This article highlights these terms, which are essential for trading in the forex market, so read carefully.

Revolving around the following main points:

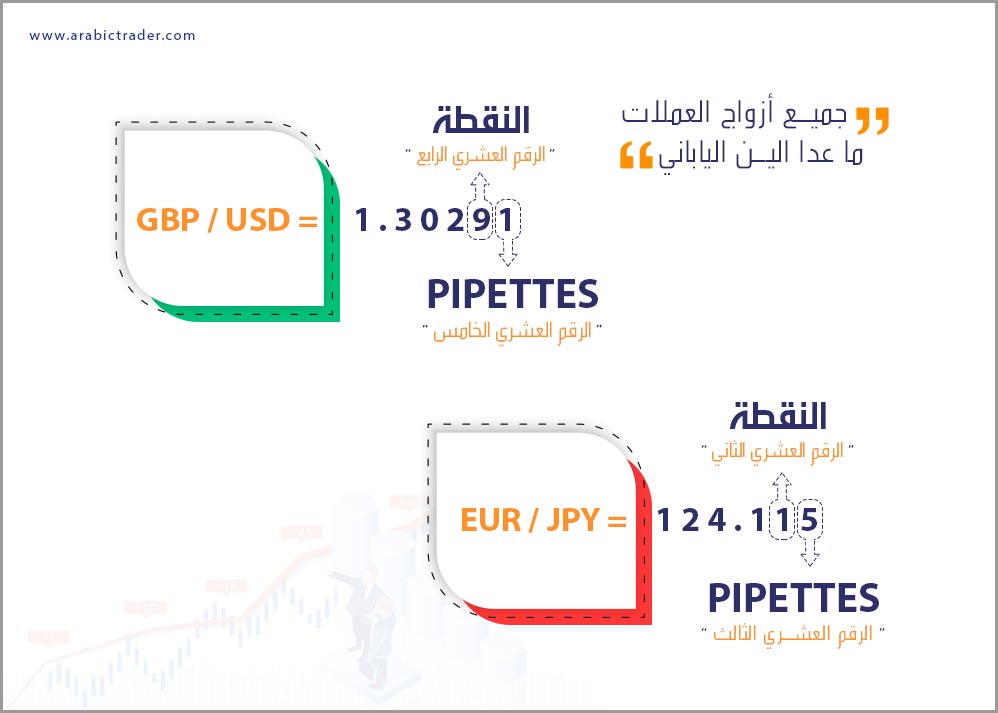

What is a Pip in Forex Trading (PIP) and What are PIPETTES?

A pip is a unit of measurement used by traders in the forex market to calculate the smallest movement in the price of a currency pair. A pip typically represents the fourth decimal place of the currency price, with exceptions for currency pairs involving the Japanese yen, where a pip is calculated at the second decimal place. The term "PIP" stands for "Percentage In Point," which indicates the percentage change represented in a pip.

PIPETTES, on the other hand, represent a fraction of a pip. Each pip consists of ten PIPETTES, which appear in the fifth decimal place for most currency pairs, while for yen pairs, they appear in the third decimal place. PIPETTES provide a finer measurement of the price spread between buying and selling.

To understand pips more clearly, let’s watch the following video:

Example of Pips in EUR/USD

EUR/USD = 1.17703

The exchange rate of the EUR/USD pair is 1.17703, and the fourth decimal place highlighted in red (0) represents one pip. If the exchange rate rises by two pips, the new price will be:

EUR/USD = 1.17723

Note: In the example above, the number 3, which is the fifth decimal place or PIPETTES, is part of the pip.

For pairs that include the Japanese yen (JPY), a pip is represented by the second decimal place. For example, for the EUR/JPY currency pair:

EUR/JPY = 124.806

The second decimal place to the right of the decimal point represents the pip. This means if the EUR/JPY exchange rate decreases by 5 pips, the new exchange rate will be:

EUR/JPY = 124.756

Note: Here, the number 6, which is the third decimal place or PIPETTES, is part of the pip.

Let’s see how these figures are displayed on a trading platform like MetaTrader 4:

In the price display above on the MetaTrader platform, notice the EUR/USD pair.

- Bid Price: 1.22286

- Ask Price: 1.22281

Therefore, the price spread is 0.5 pips:

EUR/USD = 1.22286 - 1.22281

This is displayed on the MetaTrader trading platform in the following format: 5.

What are Lots in Forex Trading?

When trading currencies or forex, trades are not executed in random amounts but rather in standard units called lots. A lot represents the quantity or volume of units that you buy or sell while trading currency pairs or financial derivatives in general.

Forex trading lots are divided into four sizes, which most forex brokerage firms offer:

- Standard Lot (1): 100,000 units of the base currency.

- Mini Lot (0.1): 10,000 units of the base currency.

- Micro Lot (0.01): 1,000 units of the base currency.

- Nano Lot (0.001): 100 units of the base currency.

Brokerage firms may present lots based on volume or number. When displayed by volume, they appear as thousands or hundreds of thousands on the trading platform, such as:

- 100,000 units

- 10,000 units

- 1,000 units

Others may display them by number, such as:

- 1 lot

- 0.1 lot

- 0.01 lot

You can trade forex using any multiples of these lots. For example, buying or selling 4 standard lots or 2 mini lots or 6 micro lots, or more or less according to your preference.

For instance, buying 1.5 lots on the EUR/USD pair means purchasing 150,000 units of euros against dollars. In other words, it means buying one full standard lot and 5 mini lots.

To further explain trading lots in the forex market, you can watch the following educational video:

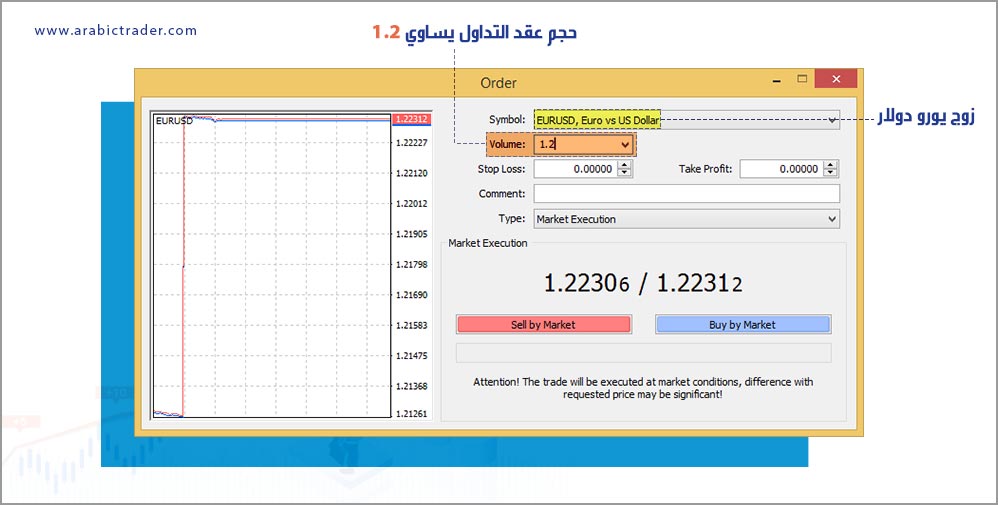

For example, on the MetaTrader 4 platform, which uses the number of lots as the format for displaying trade contracts:

Buying 1.2 lots on the EUR/USD pair means you will purchase 120,000 units of euros against US dollars (EUR/USD).

Important Note: Currency exchange rates fluctuate within a narrow range. As we explained, we always monitor the fourth decimal place, but what makes these pips valuable to traders in the forex market is the trading lots. Since we trade large quantities of lots, the value of a pip becomes significant in relation to the size of your trading account.

How to Calculate the Value of a Pip in Forex Trading?

After understanding the concept of a pip and how to determine it in the exchange rate of a currency pair, and knowing the sizes of forex trading lots, we will now present how to calculate the value of a pip for each currency pair, which depends on the currency pair and the lot size you are trading. Calculating the pip value is the first step before determining the value of profits and losses for trades.

Assuming you are trading one standard lot (100,000 units of currency), how do you calculate the pip value for currency pairs?

If the US dollar is the counter currency, then:

Pip Value = (Pip Decimal ÷ Exchange Rate) × Lot Size × Exchange Rate

In this case, the pip value will always be $10 regardless of the exchange rate.

Example: Let's say the currency pair is the GBP/USD with an exchange rate of 1.29000:

(0.0001 ÷ 1.29000) × 100000 × 1.29000 = $10

Thus, it can be said as a general rule, when the USD is the counter currency, the pip value for each lot is as follows:

- In a standard lot (1.00) with 100,000 units, the pip value = $10.

- In a mini lot (0.10) with 10,000 units, the pip value = $1.

- In a micro lot (0.01) with 1,000 units, the pip value = $0.10 (10 cents).

If the dollar is not the counter currency, we apply this formula to the rest of the currency pairs:

Pip Value = (Pip Decimal ÷ Exchange Rate) × Lot Size

Example: For the USD/CAD currency pair with an exchange rate of 1.32400, we want to calculate the pip value for a standard lot of 100,000:

Pip Value Calculation:

(0.0001 ÷ 1.32400) × 100000 = $7.55

Important Note: However, to calculate the pip value for yen pairs where the dollar is not in the currency pair:

Example: For the CAD/JPY pair with an exchange rate of 80.25, we want to calculate the pip value for a standard lot of 100,000:

Pip Value Calculation:

Pip Value = Lot Size × (0.01 ÷ Exchange Rate)

100,000 × (0.01 ÷ 80.25) = $12.46 CAD

To find the pip value in dollars, we divide the pip value in Canadian dollars by the current exchange rate for USD/CAD, since the Canadian dollar is the counter currency in this pair = $12.46 ÷ 1.3244 = $9.4.

Important Note: The pip value varies for each pair, and the forex trading program calculates these values automatically, so there is no need for manual calculations.

This educational video simplifies what we discussed about calculating pip value in forex:

Also, this website offers a special calculator for calculating the pip value for different currency pairs based on the lot size used in the trade according to the current exchange rate.

How to Calculate Profit and Loss in Forex Trades in Dollars

First, Calculate Profit and Loss in Pips

Assuming you opened a buy trade with a mini lot on the EUR/USD currency pair at an exchange rate of 1.12515.

If the exchange rate rises to 1.12609, you will make a profit of (12609 - 12515) = 94, and since the pricing precision is five decimal places, the profit in pips for the trade = 9.4 pips.

If the exchange rate drops to 1.12381, you will incur a loss of (12515 - 12381) = 134, which means the loss in pips for the trade = 13.4 pips.

Secondly, Calculate Profit and Loss Value in Dollars

To calculate the profit or loss value in dollars for forex trades, multiply the pip gain or loss by the pip value, which equals $1 for the mini lot in pairs where the US dollar is the counter currency.

So:

- Profit Value in the first case = $9.4

- Loss Value in the second case = $13.4

As mentioned earlier, all these calculations are done automatically in the trading program, but a forex trader should understand how to calculate their profits and losses, without needing to perform these calculations before every trade.

Conclusion

In conclusion, understanding the concepts of pips and lots is fundamental for anyone engaging in forex trading. These terms not only help you grasp market movements but also allow you to calculate profits and losses effectively. As you navigate the forex landscape, mastering these concepts will enable you to make informed trading decisions, enhancing your overall trading strategy and success in the dynamic world of currency exchange.

A pip is the smallest price movement in the forex market and typically represents the fourth decimal place of a currency pair.

A lot is a standard unit of measurement for trade sizes in forex, with standard lots being 100,000 units, mini lots being 10,000 units, micro lots being 1,000 units, and nano lots being 100 units.

Pip value is calculated based on the size of the trade and the currency pair, with the formula being (Pip Decimal ÷ Exchange Rate) × Lot Size.

Profit and loss can be calculated by determining the change in pips and multiplying it by the pip value for the respective lot size.

.png)