Forex Leverage and Margin

Leverage and margin are among the most essential fundamentals of trading in Forex, and understanding how they work is crucial for anyone looking to trade currencies in this market. You might have noticed that currency trading contracts in Forex are relatively large, with the smallest contract, the nano lot, equaling 100 units of the base currency. This raises an important question:

How can an investor with a small capital trade to achieve satisfactory profits in Forex?

In this article, we will answer this question by explaining the following points:

- What is Leverage?

- What leverage sizes do Forex brokers allow?

- How does leverage work, and what is the Margin system?

- What is Equity, what is available margin, and what is required margin in Forex?

- What is the difference between a Margin Call and Stop-Out in Forex trading?

- Frequently asked questions about leverage.

What is Leverage?

In the beginning, the Forex market was limited to large investors with substantial capital that allowed for good profits from currency movements. However, with the market's evolution and the emergence of brokerage firms, the concept of leverage and margin was introduced, enabling smaller traders to participate in Forex trading and earn reasonable profits from price fluctuations that are usually within narrow ranges.

The concept of leverage in financial markets refers to the ability to control or trade large amounts of capital using a very small amount of your actual deposited funds. Leverage is a facility provided by the broker to the investor or trader, allowing them to trade with multiples of their actual capital. For example, if the brokerage offers a leverage of (1:50), it means that the broker enables the investor to trade with 50 times the size of their market transactions.

This means that the brokerage has effectively allowed the trader to execute trades worth 50 times the original amount, and this leverage is returned to the broker immediately after the trade is closed, with profits or losses calculated and added or deducted from the original capital.

To clarify, if you open a trade on EUR/USD worth $1,000, this trade in the market will be valued at $50,000 due to the facility provided by the brokerage. This is what makes the profit or loss ratio compared to the original amount significantly large.

What Leverage Sizes Do Forex Brokers Allow?

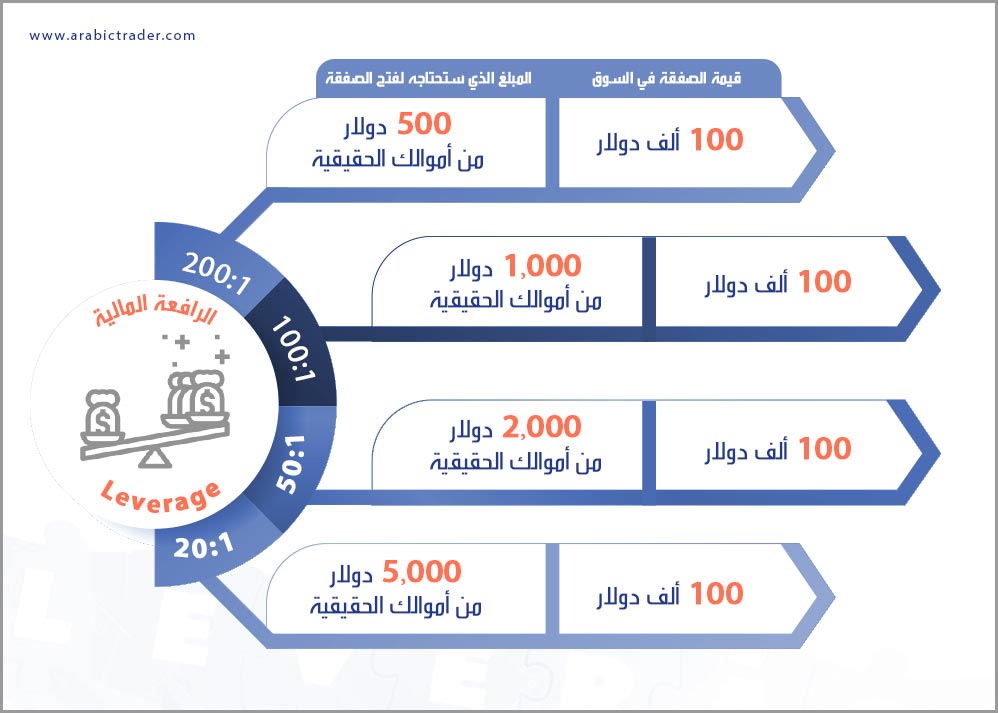

Forex brokers offer various leverage sizes, with some providing leverage exceeding 1000 times the capital. However, regulatory bodies supervising brokerage firms have imposed limits on these leverage levels in some countries due to the associated risks, which can be among the main reasons for losses in Forex. The type of license or regulatory authority supervising a brokerage firm influences the leverage size the firm can offer its clients, with common sizes being:

- 20:1 leverage

- 50:1 leverage

- 100:1 leverage

- 200:1 leverage

For instance, a leverage of 100:1 means that every dollar you use in your trades will be multiplied to $100 in the market when opening positions. Let's illustrate the different leverage values with an example:

Suppose you want to open a trade on USD/CAD worth $100,000; you would need $100,000 in actual capital to open this trade in the market without leverage. However, with leverage, you won’t need the entire amount, and only a small amount will be required.

How Leverage and the Margin System Work

Leverage in Forex operates through a system known as the margin system, which is integrated with leverage. Margin is a small amount reserved from your capital that allows you to open a new trade in the market, determined by the size of the trading contract and the leverage amount. Margin is not a fee or commission but acts as a guarantee that allows the trader to keep a trade open in the Forex market. This amount is returned to the account after closing the trade, and the broker uses the margin to protect itself and cover any losses that may occur during trading. The required margin is usually very small compared to the trading contract size.

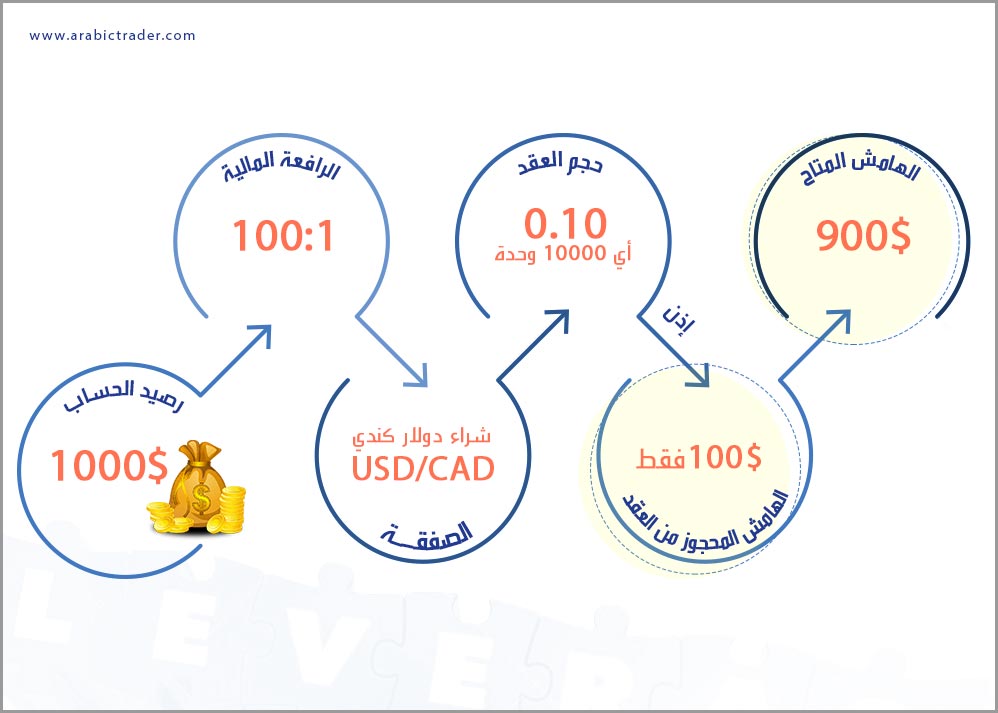

To understand the leverage and margin system in Forex, you need to have a good grasp of trading contracts. Consider the following example:

Suppose a trader has a balance of $1,000 in their account with a broker offering a 100:1 leverage. They want to open a buy trade on the USD/CAD pair with a mini lot size of 0.10, which equals 10,000 units of the base currency, in this case, the US dollar.

Without leverage, the Forex trader cannot execute a buy trade for 10,000 units with only $1,000 in their account. However, with the margin and leverage system, they can do this. The brokerage will open the contract for the trader in exchange for holding a specific amount of capital that corresponds to the contract size and leverage, known as "required margin," calculated by dividing the contract value by the leverage:

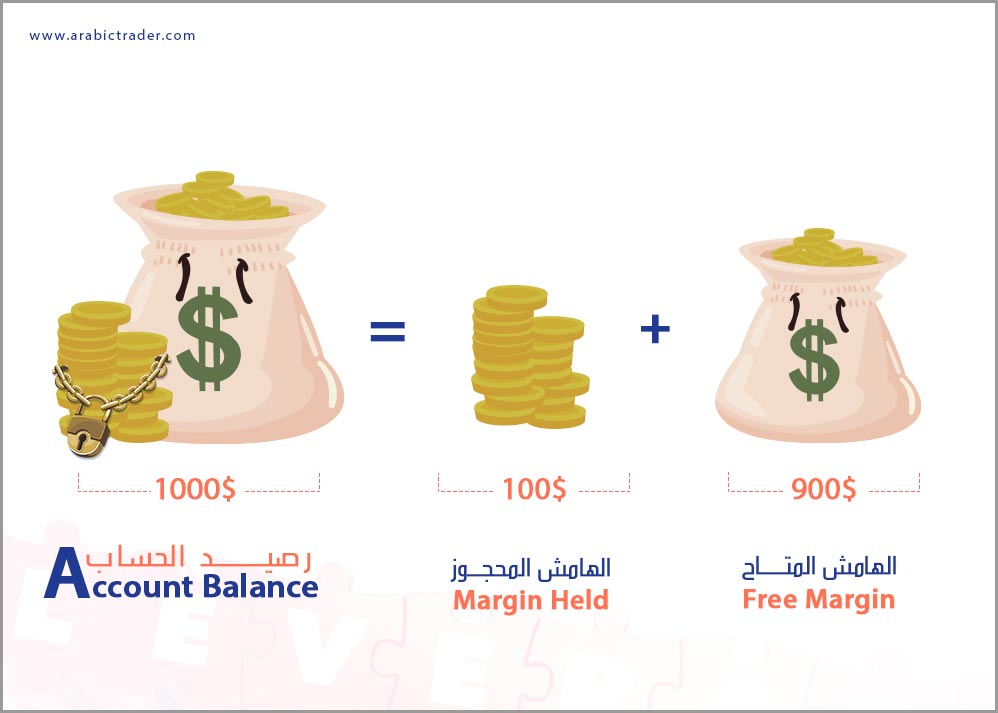

10,000 ÷ 100 = $100

Thus, $100 will be deducted as required margin from the capital, leaving the trader with $900, which is the available margin.

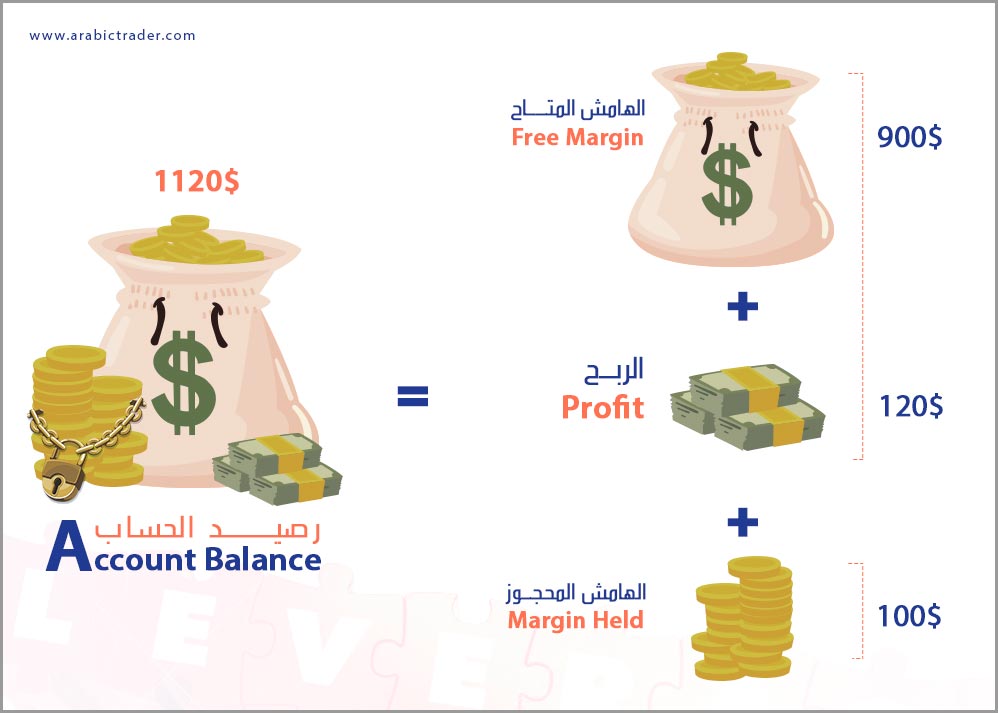

If the trade is closed after making a profit of $120, this amount will be added to the client's balance, and the brokerage will return the previously reserved margin, bringing the balance to $1,120.

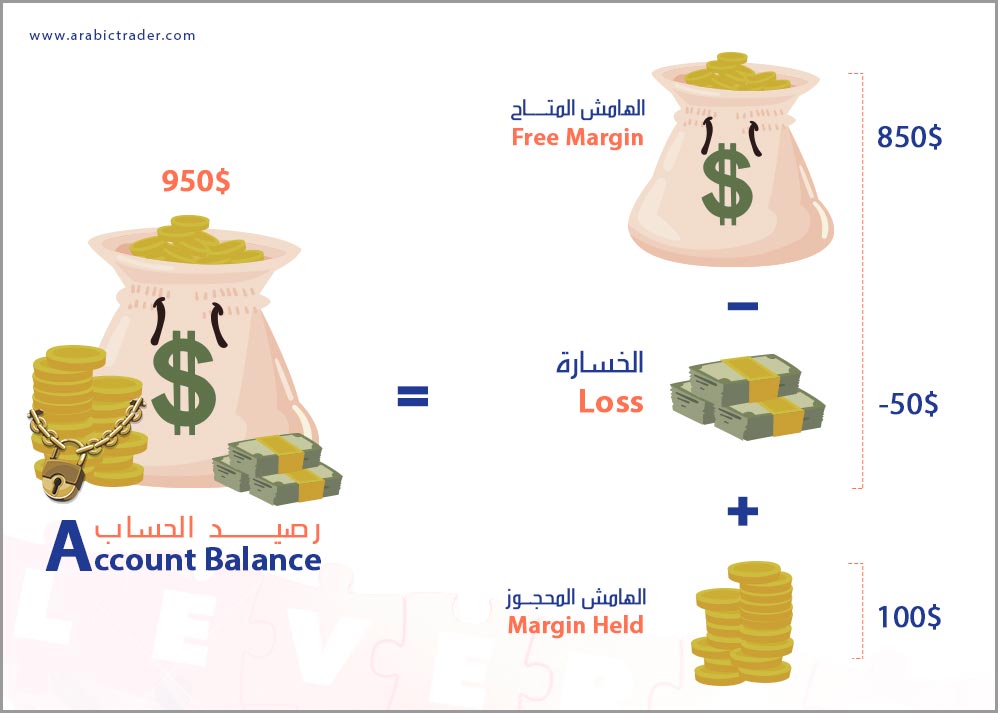

If the trade is closed after a loss of $50, this will be deducted from the client’s balance, and the brokerage will return the reserved margin, resulting in a new balance of $950.

What is Equity, What is Available Margin, and What is Required Margin in Forex?

What is Equity?

When you see the term equity on the trading platform next to your account balance, it refers to the current value of your trading account, changing instantly with market movements affecting your open trades. Equity represents your account balance plus the total of unrealized profits or losses from your open trades.

Required Margin:

This is the total amount that the broker reserves from your account balance to maintain open positions in the market, and thus the required margin can never exceed your account balance.

Free Margin:

This is the difference between your current equity and the required margin, also known as Usable Margin. Free margin refers to the funds that a trader can use to open new trades in the market, which changes positively or negatively with open positions.

It is crucial to note that leverage can be a double-edged sword, meaning it allows Forex traders to enter larger trades that can yield significant profits, but it can also lead to substantial losses, even the complete loss of the account if not used wisely and carefully.

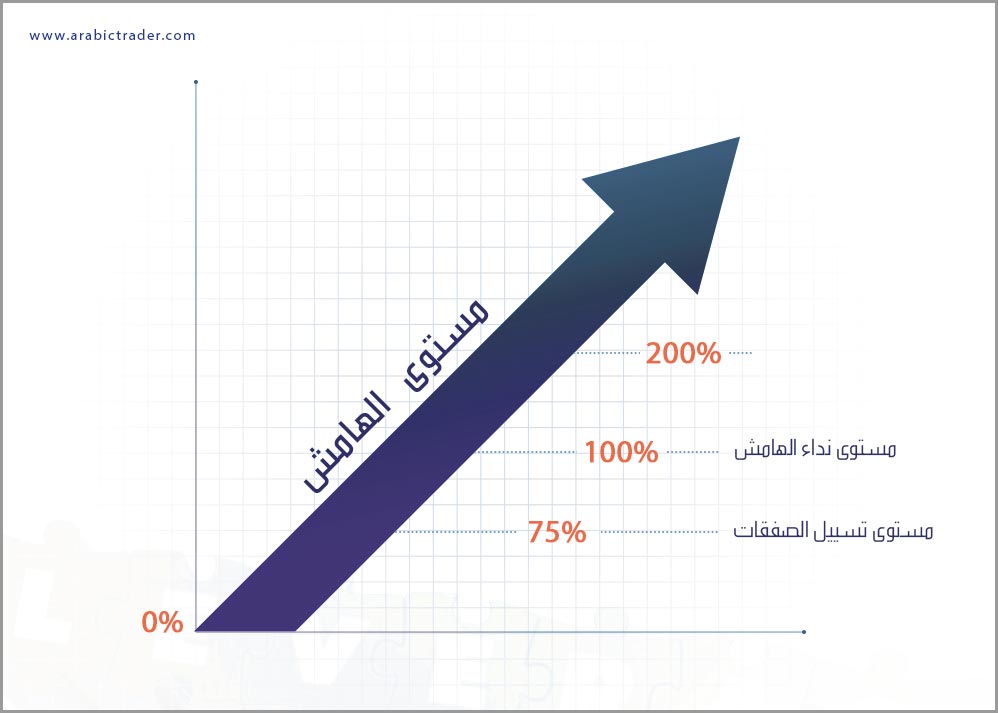

What is Margin Level?

Margin Level is an important metric that you should know; it represents the percentage value of equity compared to the required margin. Margin Level can be expressed by the following formula:

Margin Level = (Equity ÷ Required Margin) × 100

By examining your margin level, you can determine whether you can enter new trades. The higher the margin level in your trading account, the more positions you can open. Conversely, when the available margin level decreases, the funds available to open new trades decrease as well. When the margin level is at 100%, it means you cannot open any new trades.

What is the Difference Between a Margin Call and Stop-Out in Forex Trading?

What is a Margin Call?

When the margin level reaches a specific percentage (this percentage varies from broker to broker), the broker alerts the trader that their account is approaching a risk stage to take appropriate action. This stage or alert is called a Margin Call, as the broker is essentially drawing the trader's attention to what is happening with their account. If the trader does not take suitable action, the situation may worsen, and they could lose more funds. In this case, the broker will automatically liquidate or close positions, which is referred to as Stop-Out to prevent further losses.

Thus, a Margin Call occurs at a specified margin level where positions are close to automatic liquidation to prevent further losses to the trading account. The margin level at which a Margin Call occurs varies from broker to broker.

What is Stop-Out Level?

The Stop-Out Level is a specified margin level at which the broker will automatically close positions. This may involve closing some or all of the open positions to prevent further losses to the account, which could exceed the funds available in the account, thus exposing the broker to potential losses as well.

This liquidation occurs because the trading account can no longer support the open losing positions due to insufficient available margin reaching a certain point, and the broker will start automatically closing your trades, beginning with the most unprofitable ones, until the margin level rises above the Stop-Out level.

It is essential for traders to know their broker's Margin Call level and Stop-Out level. For instance, if you opened a trading account with a broker where the Margin Call level is 100% and the Stop-Out level is 75%, this means:

If you have open positions and your account margin level is at 100%, you will receive an alert from the broker that you are at risk of experiencing a Stop-Out. If the margin level drops to 75%, some or all of the open positions will be automatically closed.

The Difference

A Margin Call is the alert sent by the broker to the trader about the impending automatic closure of positions; it is simply a message or notification. In contrast, Stop-Out refers to the specific margin level at which liquidation occurs, which happens after receiving a Margin Call notification.

Leverage allows traders to control larger positions in the market with a relatively small amount of capital. For example, a leverage ratio of 100:1 means you can trade $100,000 with just $1,000.

A Margin Call occurs when your account’s margin level falls below a specified threshold, prompting the broker to alert you to take action to prevent liquidation of your positions.

A Margin Call is a notification of potential liquidation, while Stop-Out refers to the automatic closure of positions when the margin level reaches a certain point.

Leverage can magnify both profits and losses. It allows for larger trades, but improper use can lead to significant losses, including the potential for losing your entire trading account.