What is Bitcoin?

Bitcoin (BTC) is the first and most well-known cryptocurrency, recognized even by those who find digital currencies a puzzling enigma. While some regard it with skepticism, others view it as a revolutionary advancement in finance and technology. In this lesson, we will shed light on Bitcoin's origins, its nature, and how it operates.

We will discuss the following points:

- What is the primary purpose behind creating Bitcoin?

- Historical overview of Bitcoin

- What is Bitcoin?

- How does Bitcoin work?

- Bitcoin Mining

- Transactions and Transfers: Receiving, Owning, and Spending Bitcoin

- Types of Bitcoin Wallets

- Advantages and Disadvantages of Bitcoin

- Frequently Asked Questions About Bitcoin

What is the primary purpose behind creating Bitcoin?

The concept of Bitcoin originated in 2008 as a reaction to the global financial crisis, which severely impacted economic systems worldwide due to the reliance on banks as intermediaries for all financial transactions. Amid widespread dissatisfaction with banks and financial governance systems, the idea of separating banks from financial transactions emerged, introducing decentralization. This means conducting transactions—be they transfers or electronic payments—without the need for confirmation from a third party, indicating that banks are not required to participate in every transaction.

The main goal and driving force behind the creation of Bitcoin were to grant full financial control over funds to its holders, rather than relying on an intermediary bank that could monitor or restrict transactions, or on a government that could seize funds. However, two crucial factors were essential for the success of this idea: security and privacy.

Consequently, Bitcoin was established as a means for individuals to participate in financial transactions without depending on banks or governments. Based on the peer-to-peer (P2P) model, this approach was derived from a data transfer mechanism known as "torrenting," where files are shared across a decentralized network of users. For instance, if you want to download a file from the internet, instead of downloading it from a single server that grants or denies access, torrent programs divide the file into pieces and transfer them to devices that have previously downloaded the file. When you download the file, these users become providers for you, and once the first piece downloads onto your device, you also become a provider for others. Everyone has the file and knows that some are supplying pieces while others are receiving, without knowing precisely who is who, ultimately ensuring the file reaches its destination.

In the same way, Bitcoin was created: no one controls your money, and transactions are generated, secured, and verified through encryption that divides data and information for each transaction into pieces distributed across the devices of contributors, verified and secured by a decentralized network without any constraints.

Historical Overview of Bitcoin

Bitcoin is the first cryptocurrency, invented by an unknown individual or group under the name "Satoshi Nakamoto" in 2009, who stated that they began writing its code in 2007 and created a website called bitcoin.org. Nakamoto collaborated with other developers on programming Bitcoin, and many experts estimate that they mined approximately one million Bitcoins when it was still a centralized governance currency, as all control keys and coding were with Nakamoto before their disappearance in mid-2010.

Before Nakamoto's disappearance, they handed over the control of the source code and the network alert key to another developer named Gavin Andresen, who was a developer and graphic designer residing in Amherst, Hampshire County, Massachusetts, USA. Gavin Andresen later sought to decentralize control over the digital currency. This marked the first step toward the future development of Bitcoin to become what we know today, significantly differing from the initial control system envisioned by Nakamoto.

Note: The first real payment transaction made using Bitcoin was conducted by Laszlo Hanyecz—a programmer in Florida who was part of the Bitcoin development team—who paid 10,000 Bitcoins for two pizzas from Papa John's.

The year 2017 was a pivotal year in Bitcoin's history as the number of companies accepting Bitcoin continued to grow, gaining significant popularity and legitimacy. Japan passed a law recognizing Bitcoin as a legal payment method, and Russia announced it would legalize the use of cryptocurrencies like Bitcoin. By 2019, the number of Bitcoin ATMs worldwide reached approximately 5,500. In 2020, the Frankfurt Stock Exchange recognized the first Bitcoin Exchange-Traded Note (ETN), and PayPal announced it would allow users to buy and sell Bitcoin on its platform.

What is Bitcoin?

It's essential to clarify the difference between Bitcoin as a system or project and Bitcoin as a digital currency.

Bitcoin is a decentralized currency, operating without the intervention or control of a central bank, manager, or intermediary. All transactions transfer from one user to another through a decentralized network of nodes that hold encrypted information about these transactions, verified through a distributed transaction ledger that utilizes blockchain technology.

Bitcoin serves as the foundation of cryptocurrencies and is the most widely recognized and popular. However, there are thousands of other cryptocurrencies, commonly referred to as altcoins.

The Bitcoin system consists of a network of computers used for mining—also referred to as nodes or miners—running the Bitcoin code and storing its blockchain. Each block contains a group of transactions. All computers/nodes running the blockchain share the same list of blocks and transactions in encrypted forms.

Bitcoin is stored in what is called a digital wallet, which has a unique Bitcoin address and is secure. It can only be accessed through unique passwords known as keys. The public key is used by the wallet owner to receive Bitcoin transfers, while the private key allows individuals to authorize transferring Bitcoin from their wallet to another wallet.

How Does Bitcoin Work?

Every transaction made through Bitcoin (BTC) is recorded on the blockchain, which acts as the main ledger of the network, somewhat resembling a massive database. It is maintained and monitored by numerous people worldwide. Each person—virtually—uses a computer referred to as a node. Each node in the network verifies the validity of new blocks added to the chain.

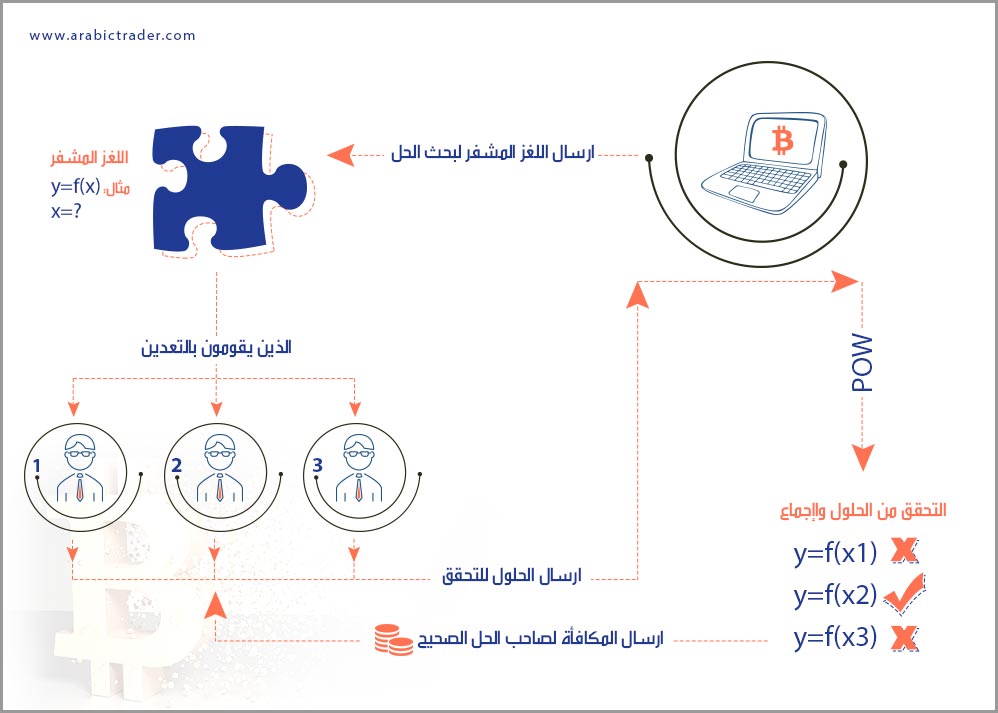

New transactions are grouped into blocks and added to the blockchain. To validate new blocks, a process called Proof of Work (PoW) is employed, which requires solving a complex cryptographic puzzle. This puzzle-solving process is known as mining and demands high computational power and significant electricity to execute; typical personal computers are inadequate for this task.

The Proof of Work mechanism is fundamentally a decentralized consensus process that requires contributors (nodes) in the network to exert effort to solve the complex encrypted puzzle, preventing anyone from manipulating the system. Proof of Work is widely used in mining cryptocurrencies to validate transactions and mine new digital currency pieces securely and privately without needing a third party.

As a currency, Bitcoin rewards those who successfully solve the puzzle and decode it. The simple concept behind this process involves searching and inferring knowledge from a vast dataset without preconceived notions about what that data might represent—akin to mining for precious metals in a mountain of rock without knowing whether it contains a known type of mineral.

Bitcoin Mining

The concept of Bitcoin mining is theoretically similar to the mining of gold or silver, with the distinction being that Bitcoin mining is conducted using giant computers and processors instead of drilling equipment to search for solutions to puzzles in encrypted content and complex mathematical codes.

Bitcoin mining serves to record transactions by harnessing the processing power of computers. Miners maintain the integrity and completeness of the blockchain's record-keeping by gathering transactions, validating them, and adding new transaction blocks to the chain. Each block contains a partial encryption code derived from the previous block using hash algorithms that link the blocks together and give the blockchain its name.

For the new block to be accepted by the rest of the network, it must include a Proof of Work, requiring the miner to find a cryptographic number called a "nonce," a random value used only once. This nonce is easy for the network to verify, but miners must try an enormous number of nonce values, such as 1, 2, 3, and so on, to reach the correct one.

To illustrate the difficulty of finding this value, in March 2014, it was estimated that miners would need to try approximately 14.6 quintillion nonces (a quintillion equals 18 zeros) to create a new block. This figure increased to 200.5 quintillion a year later.

As of July 9, 2016, those who successfully added a new block to the blockchain were rewarded with 12.5 newly created Bitcoins, processed under the name Coinbase, treated as a payment transaction. All Bitcoins created through mining enter the network via Coinbase, originally a reward for successful mining.

Notably, not everyone who engages in Bitcoin mining receives a reward, as competition among miners to solve the puzzle is fierce, and only one can win. This winner submits the solution to the puzzle or Proof of Work. The nodes on the network verify the solution mathematically and add the block to the blockchain for transaction verification, at which point the miner receives their reward.

The Bitcoin protocol stipulates that the reward for adding a new block halves every 210,000 blocks mined—approximately every four years—until it reaches zero upon reaching the Bitcoin cap of 21 million, at which point rewards will solely be based on transaction fees.

Due to the challenges of Bitcoin mining, which require costly computers and processors, many miners turn to cloud mining services offered by companies providing the necessary equipment and computers, renting space on a private server to conduct mining without the logistical burdens.

Transactions and Transfers: Receiving, Owning, and Spending Bitcoin

How does a person own Bitcoin?

The answer to this question is straightforward. In the blockchain, each Bitcoin is recorded in what are called Bitcoin addresses. Creating this address involves selecting a random private key and computing the corresponding address, occurring in fractions of a second. It’s essential to note that these private keys are numerous to the point that it’s nearly impossible for someone to choose a key already selected. A Bitcoin address indicates the source or destination of a BTC transaction. If you want to send Bitcoin to someone, you can transfer it from your Bitcoin address to the Bitcoin address of that individual, just like sending an email.

For example:

0.02568445 BTC was transferred from the Bitcoin address 15Q3jKu3U568Rzu5Ae7EZHeyUNdzQ5sS3a to the Bitcoin address 1LG5sS3awfi6e7EZ5xQrr1wfv54dfigpJEK3t on May 15, 2021, between 08:13 and 08:22 AM.

Note: Once a Bitcoin address is used for the first time, it reveals its identity and exposes its previous transaction data. Anyone within the network can view the balance and all transactions from any address. Given that the blockchain is permanent, Bitcoin addresses should only be used once, and a new Bitcoin address should be utilized each time you receive a new transaction to maintain your privacy.

To obtain a Bitcoin address, you first need to create and download a Bitcoin wallet, which is a program that allows you to send, receive, and securely store Bitcoin within the network. These wallets also store your private key, essentially your Bitcoin password. Each time you conduct a transaction to send or receive Bitcoin, the program will generate a completely new Bitcoin address for you.

To spend Bitcoin, the owner must know the private key for their address and digitally sign the transaction to authenticate it. The signature is created using the hash of the previous transaction and the public key of the next owner, allowing the recipient to verify the signatures and check the chain of ownership. The transaction is then verified by the network using the public key.

If someone attempts to forge a transaction by altering a previously stored block in the blockchain, the hash algorithm of that block will change. If anyone checks the validity of that block by verifying its hash, they will find it differs from the previously stored one, revealing the forgery and preventing the transaction from being validated.

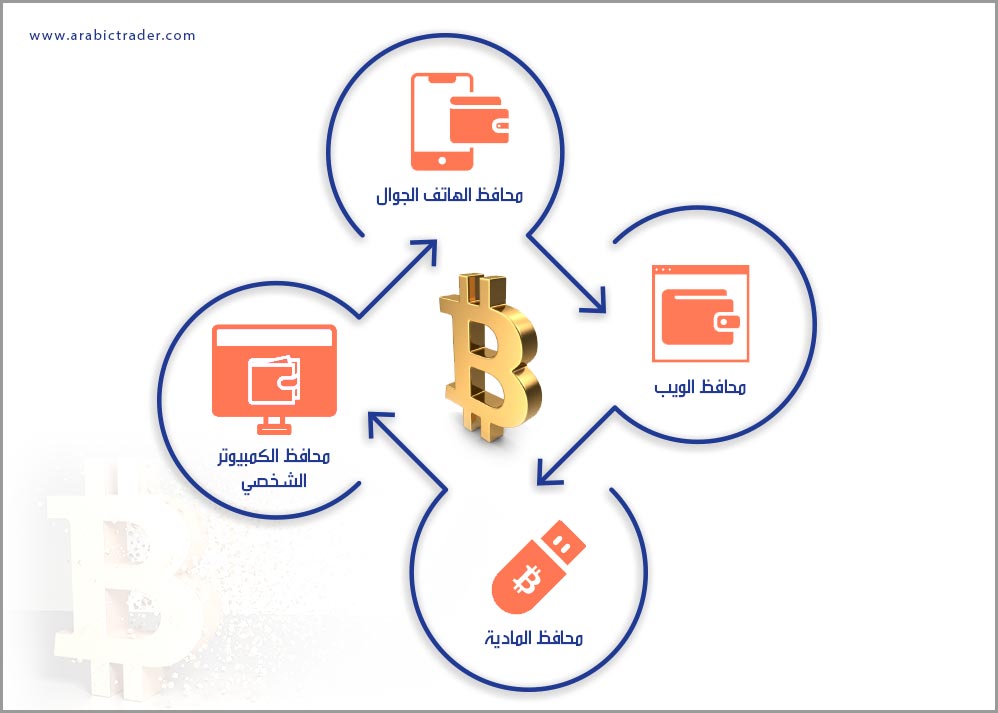

Types of Bitcoin Wallets

A Bitcoin wallet is the electronic interface for a user's Bitcoin, which can be a program on a computer, mobile device, or even accessed via the web. The wallet holds the user's Bitcoin balance but does not actually store the digital currency itself; it keeps the user's Bitcoin address and private key for accessing the Bitcoin blockchain. When making payments, wallets use the key to digitally sign transactions proving ownership of the digital currency in the network.

There are four types of Bitcoin wallets you can use: mobile wallets, web wallets, desktop wallets, and hardware wallets.

-

Mobile Wallets

Mobile wallets are the most convenient for access. However, your wallet provider stores your key on the app installed on your phone, so if someone knows your phone password and accesses it, they can easily transfer all your funds to one of their Bitcoin addresses. This security issue is often mitigated by allowing fingerprint authentication, available on many smartphones today, to open your mobile wallet app. -

Web Wallets

Web wallets are equally convenient for accessing your Bitcoin from anywhere on any browser or mobile device. However, they carry similar risks; if someone gains access to your login information, they can hack your account and steal all your funds. Therefore, it’s essential to secure your login details with as many authentication methods as possible.![]()

-

Desktop Wallets

Desktop wallets are programs you can install on your computer. They are more secure than mobile and web wallets but still carry some risk, as hackers can exploit vulnerabilities in desktop wallets, such as extracting unencrypted recovery phrases to steal your Bitcoins. Consider using a wallet that encrypts your private key and recovery phrases while enabling multiple authentication methods for access. -

Hardware Wallets

Hardware wallets resemble external hard drives or flash drives; they are tangible electronic devices that store your Bitcoins. They are offline physical components that you can connect to your computer for making payments or receiving BTC transfers, securely storing them after managing your transactions. This type of digital wallet is the safest for storing Bitcoins as it significantly reduces your funds' exposure to online hacking and cybercriminals.

Advantages and Disadvantages of Bitcoin

Advantages of Bitcoin

- Security: Transactions are private and secure at all times with lower fees, ensuring smooth execution. Once you own Bitcoin, you can transfer it anytime and anywhere, reducing the potential time and cost of any transaction.

- Privacy: Transactions do not contain personal information, such as names or credit card numbers, eliminating the risk of consumer data theft from fraudulent purchases or identity theft.

- Potential for Significant Growth: Some investors who buy and hold the currency wager that over time, as it becomes more popular and widely used as a currency, it will garner greater trust and usage, thus increasing demand and value.

- Decentralization: This is the primary purpose for which it was created; as a virtual alternative to traditional cash, it can avoid traditional banks or governmental oversight. This means all transactions are conducted within the decentralized network without third-party involvement.

Important Note: Keep in mind that to open an account on a cryptocurrency trading platform or exchange, and when wanting to buy cryptocurrencies with traditional currencies like the US dollar or euro, you will likely need to link a bank account or enter credit card details.

Disadvantages of Bitcoin

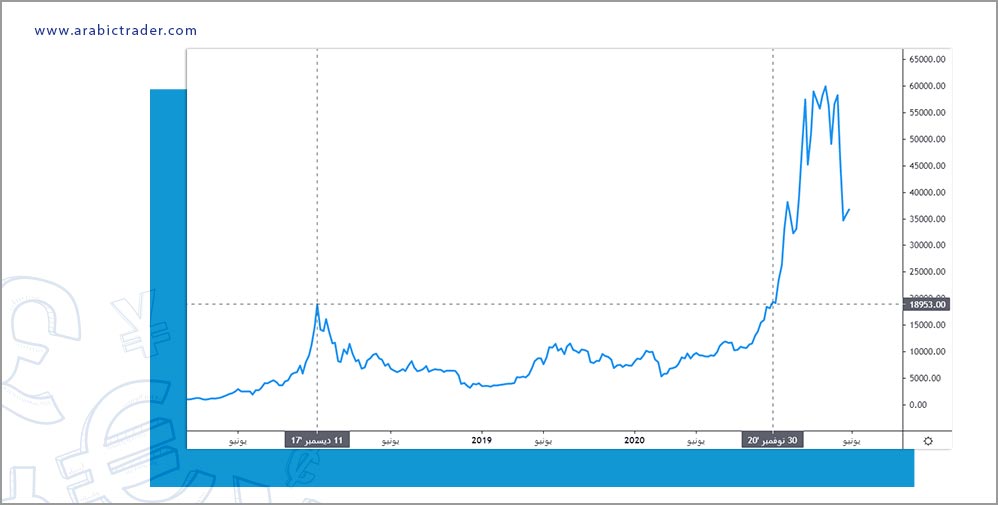

- Price Volatility: The previous rise in Bitcoin prices in 2017 was driven by speculative demand that rushed into the cryptocurrency market, particularly Bitcoin, before dropping more than 80% of its value by the end of 2018. For instance, if you bought Bitcoin at the beginning of December 2017, you would have doubled your balance by the end of the month. However, if you bought Bitcoin at the end of December 2017, you would have to wait until December 2020 to recover your losses.

- Hacking and Cybersecurity Concerns: Despite claims from blockchain supporters that Bitcoin is more secure than traditional electronic money transfers, Bitcoin wallets are attractive targets for hackers. There have been many breaches, such as in May 2019, when over $40 million worth of Bitcoin was stolen from several accounts on the Binance exchange platform.

- Limited (but Increasing) Use as Payments: Currently, we cannot say that Bitcoin is universally accepted as an effective 100% alternative to traditional cash, but over time, Bitcoin has gained popularity and acceptance, both from financial institutions and businesses and from individual users.

- Unprotected and Uninsured Financially: Insurance companies protect investors' securities transactions against failure or theft, but this type of insurance does not cover cryptocurrencies.

Conclusion

Bitcoin stands at the forefront of the cryptocurrency revolution, offering a decentralized alternative to traditional currencies and payment methods. Understanding its mechanisms, advantages, and disadvantages is crucial for anyone interested in navigating the ever-evolving digital finance landscape. As Bitcoin continues to gain traction, its role in shaping the future of money is undeniable.

Bitcoin is a decentralized digital currency that allows peer-to-peer transactions without the need for intermediaries, relying on blockchain technology for secure and transparent record-keeping.

Bitcoin transactions are recorded on a public ledger called the blockchain, where each transaction is verified by a network of nodes, ensuring authenticity and preventing fraud.

Bitcoin mining is the process of validating transactions and adding them to the blockchain. Miners use powerful computers to solve complex mathematical puzzles, earning new Bitcoins as

There are several types of Bitcoin wallets, including mobile wallets, web wallets, desktop wallets, and hardware wallets, each offering different levels of convenience and security.