What is Cryptocurrency?

In an era where traditional cash transactions are diminishing and being replaced by electronic payments, the concept of cryptocurrencies has emerged. Despite initial skepticism about their virtual and electronic nature, cryptocurrencies have gained increasing acceptance and demand. This has driven their prices to unprecedented levels, integrating them into international financial transactions and capturing widespread curiosity and interest. In this article, we will shed light on cryptocurrencies, explaining their concept and how to interact with them.

We will cover the following points about cryptocurrencies:

Concept of Cryptography

Before delving into cryptocurrencies, let’s understand cryptography, which plays a crucial role in their creation and use.

Cryptography is originally a method for protecting information and data through the use of codes so that only intended recipients with the decryption key can read or understand the hidden content. The term "cryptography" can be divided into "crypt" meaning hidden and "graphy" meaning writing, indicating that it refers to written content that conceals its meaning.

In essence, cryptography involves hiding data from its usual context to another unknown to the general public, preserving its confidentiality. This practice is not new; cryptography has been used in various diplomatic and military fields historically and now finds applications in financial and informational sectors. Cryptocurrencies build upon this concept.

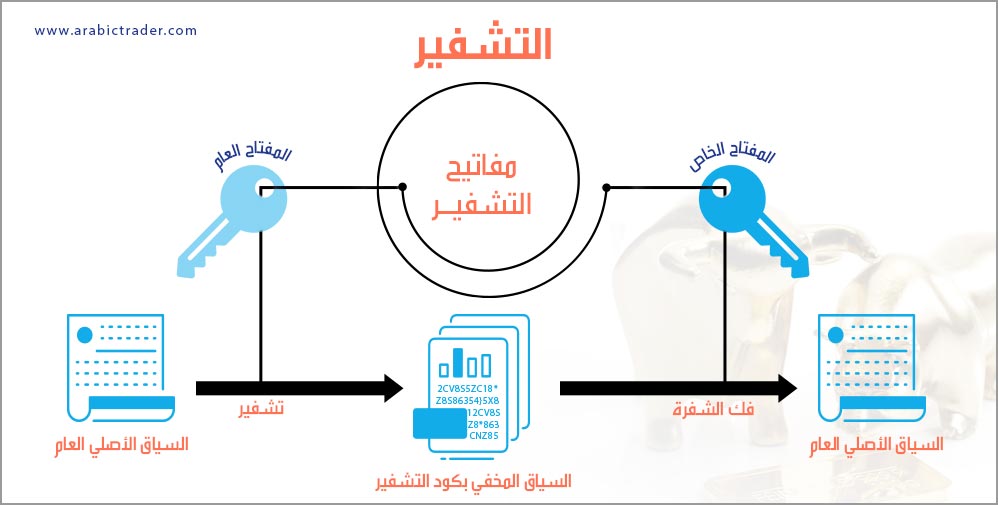

Difference between Decryption and Cryptanalysis

In contrast to encryption, decryption is the process of converting encrypted content back to its original, readable format using the decryption key.

With advances in mathematics, computing, and communications, encryption and decryption now rely on complex algorithms that are challenging to break. While theoretically possible, breaking these algorithms without the initial decryption key is impractical with current information technology. This is known as cryptanalysis, which involves studying encryption algorithms and their applications to uncover information without the required key.

In summary, decryption involves reversing encrypted data to its original form using a pre-determined key, while cryptanalysis attempts to decipher encrypted data through extensive trial and error without the key.

Origins of Electronic Transactions

Building on the principles of encryption, decryption, and cryptanalysis, the idea of creating cryptocurrencies—virtual currencies encrypted for secure and confidential transactions—emerged. These currencies are created and stored electronically without oversight from any central authority or bank, and lack a physical form like traditional money (e.g., SAR, EUR, USD).

The concept of electronic transactions began in the late 1980s in the Netherlands with fuel stations on highways experiencing high rates of theft. To address this issue, a solution involving special cards for transactions was developed, reducing the need for physical cash at these stations and decreasing theft. This led to the development of smart cash cards, representing electronically stored encrypted money, with fuel stations using point-of-sale (POS) systems to process these transactions. This marked the initial form of electronic money, which has since evolved.

Emergence of Cryptocurrencies

Around the same time as electronic transactions, an American programmer named David Chaum was developing a concept for private, secure digital money. He created an algorithm to allow money to be transferred secretly between sender and receiver using a symbolic currency called Chaum. Chaum founded DigiCash to implement this idea, which, despite its eventual failure in 1998 due to errors, laid the groundwork for cryptocurrency algorithms.

Following this, another programmer, Wei Dai, proposed a system called B-money that allowed anonymous transactions within a decentralized network. Although Dai's proposal did not achieve widespread success, elements of it were later incorporated into Bitcoin's white paper by Satoshi Nakamoto, marking a significant step in the development of cryptocurrencies.

Creation of Cryptocurrencies

As the path for cryptocurrencies was paved, technological and informational advancements led to the development of complex encryption protocols based on advanced mathematics and computer science. These protocols make it nearly impossible to break the encryption, and cryptocurrency developers used intricate coding systems to secure data transfers and conceal users’ identities, ensuring privacy.

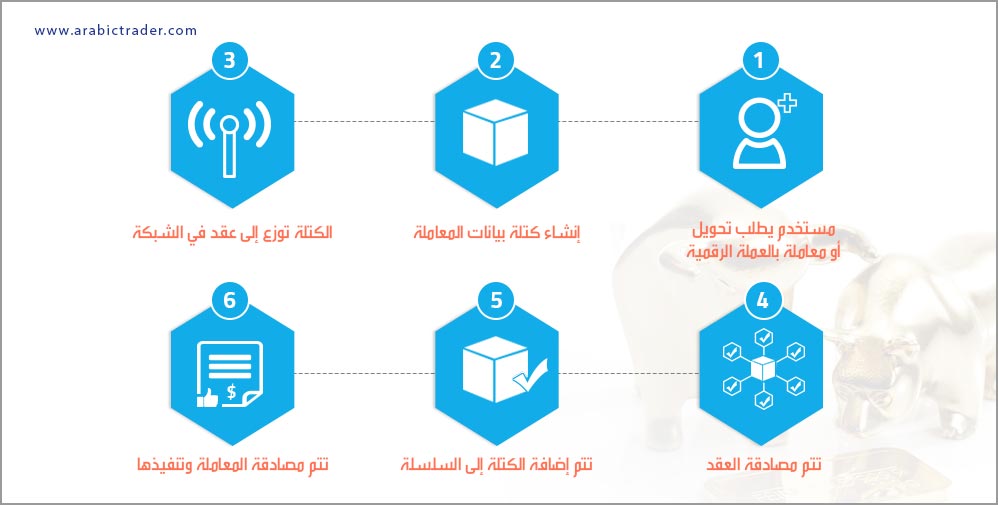

Cryptocurrencies operate as decentralized software programs distributed across many computers worldwide rather than being hosted on a single server. Their supply and value are managed through encryption protocols and are recorded in a distributed ledger known as blockchain. Mining refers to the process of adding transactions to the blockchain, and the total supply of many cryptocurrencies is capped, similar to precious metals. For example, Bitcoin has a total limit of 21 million units, and once this limit is reached, no new Bitcoins will be created.

Advantages of Cryptocurrencies

- Protection from Value Loss and Inflation: Cryptocurrencies are produced with a market cap limit, which prevents inflation and can increase in value with rising demand.

- Self-Management and Sustainability: Transactions are stored by miners on the blockchain network, which helps maintain the cryptocurrency's integrity and decentralization.

- Security and Privacy: Blockchain records are based on complex encryption algorithms, making them more secure and private than traditional electronic transactions.

- Ease of Conversion: Cryptocurrencies can be exchanged for traditional currencies, and their value is often comparable to major global currencies.

- Decentralization: Unlike traditional money controlled by governments and central banks, cryptocurrencies are decentralized and immune to central control, reducing the risk of monopolization.

- Low Transaction Costs and Speed: Cryptocurrency transactions often have minimal fees and can be completed quickly without intermediaries like banks.

Disadvantages of Cryptocurrencies

- Potential for Illegal Use: The privacy and security of cryptocurrencies can facilitate illegal transactions and money laundering.

- Risk of Data Loss: Losing access to a cryptocurrency wallet's private key means losing access to the funds stored within, as there is no recovery option.

- Limited Exchange Options: Some cryptocurrencies can only be exchanged for certain other digital or traditional currencies, which may involve additional transaction fees.

- Environmental Impact of Mining: Cryptocurrency mining requires significant energy, contributing to increased carbon emissions, especially in regions reliant on fossil fuels.

- Vulnerability of Exchanges: Cryptocurrency exchanges can be hacked, leading to theft of funds. Although most exchanges are secure, the risk of cyberattacks remains.

- No Refund Policy: Cryptocurrency transactions are irreversible, which can lead to loss of funds in case of disputes or errors.

Conclusion

Cryptocurrencies represent a revolutionary shift in the financial world, moving away from traditional cash to secure, electronic transactions. Born from the principles of cryptography, these digital assets have evolved from initial skepticism to become a significant part of global financial systems. Their decentralized nature and complex encryption provide both advantages and challenges, including privacy, security, and environmental concerns. As the cryptocurrency landscape continues to grow, understanding these aspects will be crucial for anyone looking to engage with or invest in this dynamic field.

Today, there are over 9000 cryptocurrencies in the market, and despite being virtual, they are widely accepted in electronic transactions and major global stores, with Bitcoin being a leading example.

In upcoming lessons and articles, we will explore popular cryptocurrencies, their creation, mining, and trading.

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security and operates independently of a central authority or government. Examples include Bitcoin and Ethereum.

Cryptocurrencies use blockchain technology, a decentralized ledger maintained by a network of computers, to record and verify transactions. This ensures transparency and security.

Advantages include enhanced security, privacy, low transaction fees, decentralization, and the potential for high returns on investment.