Understanding US stock market

As mentioned in the previous article, the stock market, or exchange, is the entity that brings together securities representing shares in listed companies known as stocks. The American stock market has two major exchanges for trading securities: the New York Stock Exchange (NYSE) and the NASDAQ, which include the largest and most famous global companies, with trading volumes that make them a prime destination for investors looking to enter the world of trading and investment. In this article, we will delve deeper into the American stock market.

This article covers the following points:

The Beginning of the American Securities Market

The American stock market began with the New York Stock Exchange (NYSE), established in 1792. While the Philadelphia Stock Exchange (PSE) was the first American exchange, the NYSE quickly grew to become the main stock exchange not only in the United States but worldwide, benefiting from the consistently growing American economy.

By the late 20th century, with the evolution and expansion of stock trading concepts in many other exchanges globally, NASDAQ emerged strongly as the first exchange operating electronically, executing trades through a network. This advancement supported the era of e-commerce and made the trading process more time-efficient and cost-effective, becoming a preferred venue for giant technology companies and gaining increasing significance during the tech boom of the 1980s and 1990s.

Operating Hours of the American Market

The regular trading hours for the American stock market on the New York Stock Exchange (NYSE) and NASDAQ are from 9:30 AM to 4 PM Eastern Time (ET), which corresponds to UTC -4. For example, Saudi Arabia is UTC +3, making it 7 hours ahead. Trading occurs Monday through Friday, excluding holidays and early closure days, where regular stock trading ends at 1 PM ET.

Additionally, trading can happen outside regular American stock market hours. There is "pre-market" trading that can start as early as 4 AM ET and extends to the regular market session starting at 9:30 AM, followed by "after-market" sessions, which run from 4 PM to 8 PM ET.

Exchanges in the American Stock Market

Securities, commodities, derivatives, and other financial instruments are traded on exchanges, which in the past required traders and brokers to meet physically in the exchange building. Now, most financial transactions are conducted electronically.

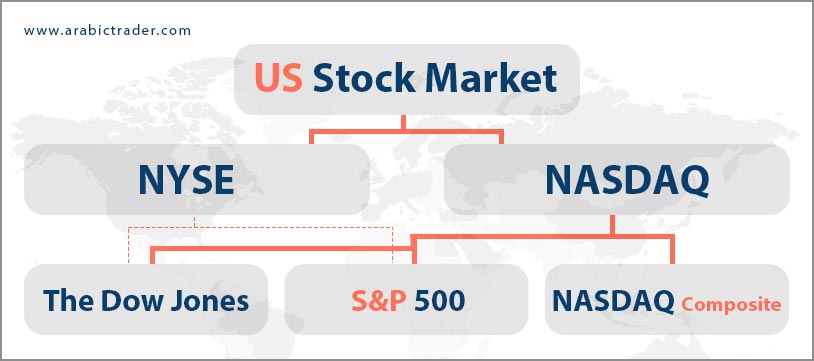

The two largest stock exchanges in the United States are the New York Stock Exchange (NYSE) and NASDAQ.

New York Stock Exchange (NYSE)

The NYSE is based in New York and has merged with a European exchange known as Euronext, forming what is now called NYSE Euronext. For a company to be listed on the NYSE, it must have more than $4 million in shareholders' equity.

NASDAQ

NASDAQ stands for the National Association of Securities Dealers Automated Quotations and is the largest electronic screen-based market. Established in 1971, it is renowned for its relatively modern computerized system compared to the NYSE. Currently, it offers lower listing fees than the NYSE and includes some of the largest companies, especially in technology.

The American market also includes smaller securities exchanges, such as:

- Chicago Board Options Exchange (CBOE)

- Chicago Board of Trade (CBOT) - owned by the CME Group

- Chicago Mercantile Exchange (CME) - owned and operated by the CME Group

- Chicago Stock Exchange (CHX)

Sectors of the American Market

Before delving into trading methods in the stock market, it’s crucial to understand the various sectors within the stock market to grasp its nature, diversification mechanisms, and classification.

A sector in the stock market is defined as a group of stocks that share many characteristics and traits, typically within similar industries or fields. Stocks are classified into sectors to facilitate comparisons among companies with similar business models, which is essential for investment considerations or when external factors affect a specific economic sector.

According to the Global Industry Classification Standard (GICS), there are 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries encompassing all major publicly traded companies. Below is a look at the American market sectors and examples of significant American stocks within each:

-

Technology Sector

- Includes information and technology innovation companies, software and hardware providers, and manufacturers of semiconductors.

- Notable Companies: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN).

-

Financial Sector

- Comprises investment and commercial banks, insurance companies, and asset management firms.

- Notable Companies: Visa (V), JPMorgan Chase (JPM), Bank of America (BAC), Mastercard (MA).

-

Healthcare Sector

- Includes pharmaceutical and biotechnology companies, medical supplies, and health insurance firms.

- Notable Companies: UnitedHealth Group (UNH), Pfizer (PFE), Johnson & Johnson (JNJ).

-

Materials Sector

- Encompasses companies involved in building materials, chemicals, and metals and mining.

- Notable Companies: BHP Group (BHP), Linde PLC (LIN), Rio Tinto PLC (RIO).

-

Utilities Sector

- Covers electric, gas, and water utilities, and independent power producers.

- Notable Companies: NextEra Energy (NEE), Dominion Energy (D), Duke Energy (DUK).

-

Real Estate Sector

- Involves companies developing or managing properties, including Real Estate Investment Trusts (REITs).

- Notable Companies: American Tower Corp. (AMT), Simon Property Group (SPG).

-

Consumer Staples Sector

- Encompasses companies in food, beverages, tobacco, and household products.

- Notable Companies: Walmart (WMT), Procter & Gamble (PG).

-

Consumer Discretionary Sector

- Covers companies selling non-essential goods and services.

- Notable Companies: Nike (NKE), Starbucks (SBUX).

-

Energy Sector

- Includes companies engaged in the exploration and production of energy resources.

- Notable Companies: Exxon Mobil (XOM), Chevron (CVX).

-

Industrials Sector

- Comprises companies involved in transportation, machinery, and construction.

- Notable Companies: Boeing (BA), FedEx (FDX).

-

Communication Services Sector

- Includes telecommunications and media companies.

- Notable Companies: T-Mobile (TMUS), Netflix (NFLX).

Indicators of the American Stock Market

Market indicators play an essential role in the general analysis of the American stock market. They not only provide an overview of market movements but also help in understanding broader economic trends and investor risk appetite.

The American market hosts a vast array of indicators, typically filtered by market capitalization and the sectors to which listed stocks belong. The three main indicators that are most followed in the American market are the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ. These indicators are tracked daily, making them benchmarks for market performance and economic health.

-

S&P 500: Represents the market capitalization of the 500 largest traded companies in the U.S., making up approximately 80% of the total value of the U.S. stock market.

-

Dow Jones Industrial Average (DJIA): One of the oldest and most followed stock market indicators, it includes shares of 30 major U.S. companies. The DJIA is price-weighted, meaning that changes in higher-priced stocks can have a more significant impact than changes in lower-priced stocks.

-

NASDAQ: Known for its tech stocks, it also includes companies from other industries. The NASDAQ is market capitalization-weighted, including both large-cap and small-cap stocks.

How Stocks are Traded on American Exchanges

Despite the prevalence of electronic trading today, individual traders still play a significant role in the exchanges. The opening and closing prices of American stocks on the NYSE are determined by supply and demand factors, often in an auction-like format.

The NYSE opens at 9:30 AM ET, initiating the opening auction. While orders can be accepted before the market opens, market orders and limit orders during the opening auction cannot be executed until the auction price is established.

The first data flow for the new trading day includes a reference price for each security, generally corresponding to the previous day’s closing price. It also includes data on the current imbalance between buy and sell orders. By publishing this data, the NYSE allows traders to adjust their trades accordingly.

At the end of the trading day, a closing auction occurs, similar to the opening auction. Although the NYSE closes at 4 PM ET, requests that help determine the closing price begin to appear even before the market opens.

Overall, the process of determining opening and closing prices in the American stock market is more than just an auction; it is designed to facilitate trading in a highly complex market, blending high technology with human interaction to create an efficient trading environment.

Conclusion

Understanding the American stock market involves recognizing its history, structure, and the functioning of its exchanges. By grasping how sectors are categorized, the importance of major indicators, and the trading process, investors can make informed decisions. This knowledge not only enhances trading strategies but also provides insights into market dynamics. By continually learning about the stock market, traders can better navigate the complexities of investing.

The main stock exchanges are the New York Stock Exchange (NYSE) and NASDAQ.

Regular trading hours are from 9:30 AM to 4 PM ET, with pre-market trading starting at 4 AM and after-hours trading until 8 PM.

The S&P 500 includes 500 of the largest publicly traded companies in the U.S. and reflects about 80% of the total stock market value.

The NYSE is a traditional exchange that has a physical trading floor, while NASDAQ operates entirely electronically, primarily including technology companies.