Introduction to Stock Markets

The financial markets play a significant role in the economy by effectively providing cash and liquidity for business and economic activities, channeling savings into various investment avenues, and directing them to sectors in need. Financial markets perform this role through financial operations, starting from issuing securities, offering them to investors, and making them available for trading. In this article, we will explore one of the oldest and most renowned financial markets: the stock market.

The topic will be discussed step by step through the following points:

The Concept of Financial Markets

Before discussing the stock market, we must first address the concept of financial markets, as the stock market is one of the oldest and most famous financial markets. As mentioned in the article "What Are Financial Markets?", they represent the entity where the buyer and seller meet to conduct a trade. The buyer is driven by the desire to own and demand, while the seller wishes to divest and make an offer. In financial markets, the financial instrument is the focus of the transaction, and the role of the financial market is to facilitate the buying or selling of the financial instrument according to the laws and regulations set by the financial market authorities in each country. This instrument could be a stock, bond, or other types of financial contracts and derivatives.

What are Stocks?

A stock is named after the concept of contribution, representing a part or share of a company's capital. The owner is considered a shareholder in the company. Stocks are equal in value and indivisible by the owner — meaning they cannot be divided into smaller pieces, such as half or a quarter of a share. They are typically tradable according to the commercial methods outlined in financial market regulations.

This leads us to another concept: the listed company.

Initially, a company is private, owned by an individual or a group in the private sector. For various reasons, such as raising funds to invest in company growth, increasing capital, or acquiring other companies or parts of them, the company will offer its shares to the public for the first time through an initial public offering (IPO). This means the company provides part of its ownership to shareholders to inject funds for a stake or share in the company, transitioning from a private company to a publicly traded company.

Thus, the company’s shares become publicly tradable, and the company's financial status is regularly evaluated by monitoring its share price and investor interest in financial markets, under the oversight and regulation of the market authority. When the company's share price rises, it indicates high demand due to its credibility, financial stability, profitability, and good performance. Conversely, a decrease in share price reflects negative performance, declining profits, increased debt, or negative news and rumors.

How Does the Stock Market Work?

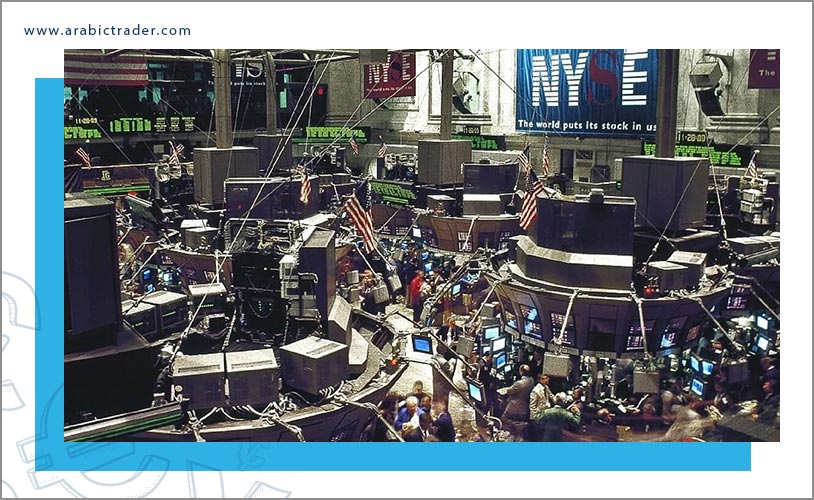

As mentioned earlier, the stock market operates by providing and organizing a market for securities (stocks) where buyers and sellers negotiate prices (supply and demand) and conduct transactions. The stock market functions through a network of exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ.

After companies list their shares on the exchange through an IPO, the company's shares are initially priced and available for trading. Investors then buy these shares. Over time, shares are available for general trading — buying and selling — among investors. The exchange monitors and regulates the supply and demand for each listed share, helping to determine the price of each share and the price levels at which investors or shareholders are willing to buy or sell.

To create demand, buyers offer prices reflecting the maximum amount they are willing to pay for the share. At the same time, sellers create offers by providing the prices they want in exchange for selling the share. The transaction occurs when the bid and offer prices meet at a mutually agreed point. Price determination is done algorithmically through clearing programs, and you will see the price difference between bids and offers on your broker’s site or platform.

Sections of the Stock Market

Having a market or exchange for trading stocks is crucial for investors to track prices and execute trades. Aside from all activities within the stock market, understanding its divisions is essential:

-

Primary Market

This is where stocks and bonds are initially created or issued. Companies offer new stocks and bonds to the public for the first time, such as through an IPO. Sales occur directly from the parent company to early investors who wish to have priority in acquiring these shares.

-

Secondary Market

This is the market known to traders, where stocks previously issued and listed in the primary market are bought and sold among investors, not involving the company itself. Examples include the New York Stock Exchange, the London Stock Exchange, or the Saudi Stock Exchange.

Example: If you want to buy a share of Apple Inc., listed under the ticker AAPL, you are dealing only with another investor who already holds shares of Apple. Apple itself does not participate directly in the transaction.

-

Over-the-Counter (OTC) Market

Sometimes referred to as the off-exchange market, this is a decentralized market where transactions occur outside the local exchange where the share is listed. Transactions are carried out electronically among investors through various trading platforms, facilitating the trading of securities not available to investors on formal exchanges.

How to Buy and Sell Stocks

The process is straightforward, just follow these steps:

-

Step One: Find a Trading Broker and Open an Account

Before buying stocks, you need to open an account with a brokerage firm, which is easy with many brokers and trading platforms available online. Once you fund the account, you can start analyzing and tracking the stocks you wish to invest in.

-

Step Two: Select the Right Stocks

After opening and funding your trading account, the next step is selecting stocks. To simplify, follow this advice: "Do not let news, data, and market fluctuations confuse you in your search for the best stocks. Simply, look for companies you want to own a part of and see them as good investment opportunities."

-

Step Three: Execute the Trade

It’s time to execute trades in your account, but before placing an order to buy a stock, know that buying stocks isn’t as simple as just pressing a buy button on a trading app. You generally need to choose the type of order:

Market Order: This directs the broker to buy stocks immediately at the lowest available price. The current stock price when placing a market order may not be the exact price at execution, as prices change rapidly.

Limit Order: This specifies the price at which you want to buy. The purchase will only be executed if the stock reaches this price or lower within a specified time frame. If the stock doesn’t reach the set price before the order expires, the trade is canceled.

-

Step Four: Sell Stocks

As an investor, the best time to sell your stocks is when you need liquidity. You should have a long-term strategy centered around a financial goal and timeline. Your plan should include the financial target you aim to achieve and the timing for selling to meet your objectives.

Remember that selling stocks — for long-term investors — is not about daily price movements. This concerns day traders or short-term speculators who plan to make quick profits. If you are not one, there is no need to worry about daily price fluctuations.

If you find yourself in the common dilemma of whether to hold a losing stock, reconsider why you bought it in the first place and whether anything fundamental has changed. If not, a price drop might be a good time to buy more. Always plan your trades and trade according to your plan.

Concept of Trading Sessions

A trading session is the available time during a workday when investors actively buy or sell stocks. The session occurs in two main phases:

-

Phase One: Orders are collected during a specified time by the exchange system and registered in the central order book for execution, matching buy and sell orders until they match and the market opens.

-

Phase Two: Continuous trading takes place, where transactions are executed based on price and timing principles. Prices are matched against offers in the order book, and trading continues until market close, with prices adjusting based on supply and demand.

Note that exchange working hours vary depending on the market and country. Generally, global markets are open from Monday to Friday, excluding official holidays. Exceptions include the Saudi and Egyptian financial markets, where trading occurs from Sunday to Thursday.

Trading Stocks Before and After Market Hours

As mentioned, the stock market has regular trading hours during the business day, excluding official holidays. However, there are exceptions with pre-market and after-hours trading sessions, representing a small portion of the daily trading volume.

-

Pre-Market Trading

This period features limited trading activity and liquidity, often with wide bid-ask spreads. Many retail brokers allow pre-market trading but may restrict order types. Despite lower liquidity, significant price movements or gaps can occur, especially for large-cap stocks.

Pre-market trading provides opportunities to react early to news such as earnings announcements or major geopolitical events, which usually reflect in the regular trading session.

-

After-Hours Trading

refers to trading that occurs after the regular trading session has ended. It typically provides an opportunity to take advantage of news and movements that occurred before or during the market close, such as earnings reports from companies. Trading volume on these stocks is usually high during the announcement period, but it generally slows down significantly after hours. Additionally, there is often a wider bid-ask spread and reduced market liquidity due to fewer participants. As a result, many investors or institutions may prefer not to engage in after-hours trading.

Conclusion

In summary, understanding the stock market is essential for anyone interested in financial markets and investing. The stock market plays a crucial role in the economy by providing liquidity and enabling the efficient allocation of resources. By grasping the basics of how stocks work, how to buy and sell them, and the various segments of the stock market, investors can make informed decisions and participate effectively in this dynamic environment. Whether you're just starting or looking to refine your strategy, mastering these fundamentals is the first step toward successful investing.

Financial markets are platforms where buyers and sellers engage in transactions involving financial instruments such as stocks, bonds, and derivatives. They facilitate the exchange of capital, provide liquidity, and help in price discovery through supply and demand dynamics.

A stock represents a share in the ownership of a company. It signifies a claim on the company’s assets and earnings. Stocks are traded on stock exchanges, and their value can fluctuate based on company performance and market conditions.

The stock market operates through exchanges where companies list their shares for public trading. Investors buy and sell stocks based on supply and demand, which determines the price of each stock. Trades are executed through brokers who facilitate the transactions between buyers and sellers.

The stock market is divided into primary and secondary markets. The primary market is where new securities are issued and sold for the first time, such as in an Initial Public Offering (IPO). The secondary market is where previously issued stocks are traded among investors. Additionally, there are over-the-counter (OTC) markets where trading occurs outside traditional exchanges.

Pre-market trading occurs before the regular trading hours of the stock market, allowing investors to react to news and events that occur outside regular hours. After-hours trading happens after the market closes and provides an opportunity to trade stocks based on news and events that emerge after the market has closed. Both periods can have lower liquidity and higher volatility compared to regular trading hours.