Member of the U.S. Federal Reserve: The Fed will stop if we face an unexpected upward inflation surprise.

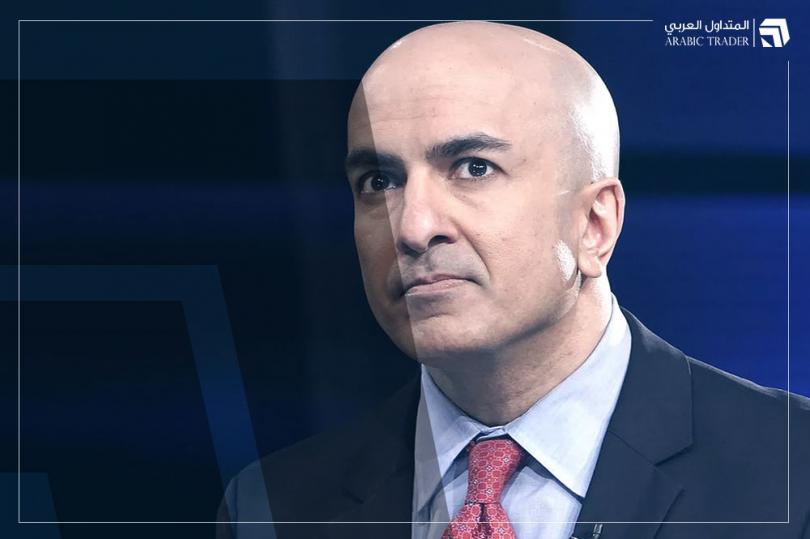

Federal Reserve member from Minneapolis, Neel Kashkari, made several important statements on Tuesday evening, the most notable of which are as follows:

- We must wait and see what the new government's policies will be.

- A one-time increase in tariffs could become reciprocal, but for now we are all just trying to anticipate.

- Potential immigration policies could have a significant impact, but we need to see what happens.

- We have a good level of confidence that housing sector inflation will return to normal levels, although it may take a year or two.

- The U.S. labor market has been surprisingly resilient; it is a strong labor market.

- The U.S. economy seems to be in a strong position.

- If inflation surprises us on the upside between now and December, it could prompt the Federal Reserve to pause (in terms of continuing the rate-cutting cycle).

- There may not be enough time for job data to surprise us and rise strongly.

- Productivity seems to have been stronger, which could mean a higher neutral interest rate.

- And if that’s the case, the Federal Reserve may not cut as much.

- We all agree that the Federal Reserve's policy is currently above the neutral level.

- The rise in long-term bond yields does not seem related to long-term inflation expectations.

- I believe the Federal Reserve's policy is at constrained levels but modestly so right now.

- In my opinion, the Federal Reserve has a long way to go in reducing its balance sheet.

- Ultimately, the economy will guide the Federal Reserve on determining the necessary time frame for interest rate cuts.